Authors: Mindy Herzfeld, Jon Holbrook, Robert Daily, Ivins, Phillips & Barker, Chartered.1

Summary

A taxpayer that exchanges one cryptocurrency for another must recognize gain or loss under general property disposition rules. See section 1001(a). Exchanges of one type of cryptocurrency for another type of cryptocurrency that occurred before January 1, 2018, may qualify for nonrecognition treatment under section 1031 depending on the facts and circumstances of the exchange. The key determination is whether the nature and character of the rights of both types of cryptocurrency are similar.

The analysis in this memo reflects the law in existence as of January 16, 2020.

Current Law

Under general tax principles, an exchange of one property for another type of property is generally a taxable event. Any gain or loss that’s realized must be recognized unless an exception applies.2 Section 1031 provides one such exception to that general rule. Section 1031 was amended by the TCJA (for exchanges that occur after January 1, 2018) and now provides a limited like-kind exchange non-recognition rule that only applies to real property. Because cryptocurrency is not real estate, section 1031 does not apply to exchanges of cryptocurrency assets after January 1, 2018. One member of Congress has considered extending section 1031 treatment to cryptocurrency, but such a proposal has not been enacted.3

Pre-2018 Law

Under Section 1031, prior to its amendment by the TCJA in 2017, the exchange of one type of cryptocurrency for another may have qualified as a section 1031 exchange. For exchanges that occurred before January 1, 2018, an exchange of “like-kind” property (i.e., not limited to real property) could qualify for non-recognition. 4

Intangible Personal Property

In Notice 2014-21, 2014-16 IRB 938, the IRS said that cryptocurrency is considered “property” (and not “currency”) for federal tax purposes. Because cryptocurrency is a digital asset, it may be considered intangible personal property. Regulations under section 1031 (promulgated prior to the 2017 statutory amendment) provide that intangible personal property qualifies for section 1031 nonrecognition “only if the exchanged properties are of a like-kind.”5 Whether the properties are of a like-kind is judged according to the nature or character of the rights involved (e.g., a patent or copyright) and the nature or character of the underlying property to which the intangible personal property relates. For example, an exchange of a copyright on one novel for a copyright on another novel may have qualified as a section 1031 exchange (under prior law) but not a copyright on a novel for a copyright on a song.6

Gold Bullion

The IRS has not issued guidance on the application of section 1031 to exchanges of cryptocurrency. We look to authorities addressing exchanges of a gold coin for another coin as providing helpful analogous guidance. Although gold coins are tangible personal property, they function in a similar way to cryptocurrency in that some gold coins operate as a storage of value and some operation as a medium of exchange.

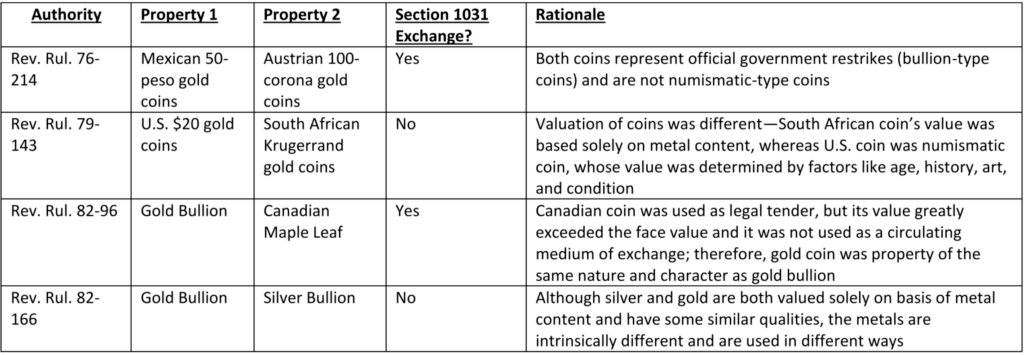

The following table summarizes authorities that address the applicability of section 1031 to transactions in which a taxpayer exchanges one or more gold coins for other coins:

These authorities consider gold bullions to be of the “same nature and character” if they are valued on metal content, but not of the same character is one bullion is valued on metal content but the other based on some other factor (e.g., age or history). And under these authorities, an exchange of one gold bullion for a gold bullion that was used as legal tender could qualify under section 1031 only if the legal tender was not used as a medium of exchange. In addition, even coins with similar qualities generally aren’t considered to be “like property” if they’re used in different ways.

Pre-2018 Cryptocurrency Section 1031 Exchanges

The IRS has addressed the federal income tax treatment of cryptocurrency in two pieces of guidance: Notice 2014-21 and Revenue Ruling 2019-24, which specifically deals with the effect of a hard fork on taxpayers holding a cryptocurrency. Neither the Notice nor the Revenue Ruling addressed the question of whether an exchange of cryptocurrency could qualify for like-kind exchange treatment under section 1031. In public forums, IRS officials have stated that cryptocurrency transactions would not qualify as like-kind exchanges under section 1031 treatment, even in the case of pre-2018 transactions. 7

Other government officials have cast doubt on that position and said that the IRS “doesn’t have a blanket policy” regarding like-kind exchanges and “will make a determination based on taxpayers’ particular facts and circumstances.”8

Based on the two-part test of the Treasury regulations applicable to determining whether intangible property may be considered “like-kind,” and the guidance relevant to exchanges of gold bullion, the following factors may be relevant in the analysis of whether an exchange of cryptocurrency for other cryptocurrencies may qualify for section 1031 like-kind treatment prior to 2018:

- Type of use: does the cryptocurrency function as a vehicle to store value (e.g., Bitcoin) or is it better characterized as a medium of exchange (e.g., Bitcoin cash)?

- Original protocol of the cryptocurrency: was the cryptocurrency created via a hard fork in one currency (e.g., Bitcoin and Bitcoin Gold)?

- Transaction verification method: does the cryptocurrency use miners and what percentage of nodes is required to approve each transaction? Does the cryptocurrency validate using a different method (e.g., via a Proof of Stake)?

- Allowance of smart contracts: does the cryptocurrency allow or not allow for the execution of legal contracts with the use of third-party intermediaries (e.g., cryptocurrencies on the Ethereum platform)?

- Valuation: does the cryptocurrency have a stable value (e.g., Tether) or does the value change based on market

demand?

Although usually, taxpayers take a basis in property equal to the amount paid for the property, both taxpayers in a section 1031 transaction take a “carryover basis” in the cryptocurrency received in the exchange, equal to the basis of the property exchanged.

1 This material was produced for the Lukka Library. This paper is not intended to be, nor should it be constructed as constituting, legal or tax advice provided by Ivins, Phillips & Barker, Chartered. Unless otherwise indicated, all “section” or “§” references are to the Internal Revenue Code of 1986, as amended, and all “Treas. Reg. §” references are to the Treasury regulations promulgated thereunder.

2 I.R.C. § 1001(a) and (c).

3 H.R. 7361 (115th Cong., 2d).

4 Courts and the IRS have construed the like-kind provision narrowly. See Calif. Fed. Life Ins. v. Comm’r, 680 F.2d 85, 87 (9th Cir. 1982) (interpreting the enactment of section 1031(e) as Congressional intent that the lenient approach to section 1031 for real estate property should not apply to non-real estate property); TAM 20050234 (Sept. 29, 2005) (“When personal property is concerned, the Service has been stricter in its determinations of what constitutes like-kind property than for exchanges of real property.”).

5 Treas. Reg. § 1.1031(a)-2(c)(1).

6Treas. Reg. § 1.1031(a)-2(c)(3).

7 Allyson Versprille, IRS Official Says Pre-2018 Crypto Exchanges Aren’t ‘Like-Kind.’, DTR (Nov. 13, 2019, 5:36 PM).

8 Allyson Versprille, IRS Walks Back Earlier Comments on Crypto Like-Kind Exchanges, DTR (Nov. 15, 2019, 5:34 PM).