The world’s most comprehensive crypto data and analytics solution.

Empower your crypto business decisions with precision and efficiency.

Lukka Insights provides a window into the largest, most comprehensive crypto data for enterprises, delivering detailed, reliable, and actionable insights for all types of participants in the crypto ecosystem. This solution offers a multidimensional view of millions of crypto assets, crypto derivatives, as well as an in-depth analysis of 2500+ crypto trading venues, marketplaces, and custodians.

1 million +

Crypto Assets

Up to 200

Data Fields

per asset or venue

2,500+

Crypto Trading Venues

Discover assets and venues within the crypto ecosystem with Lukka Insights.

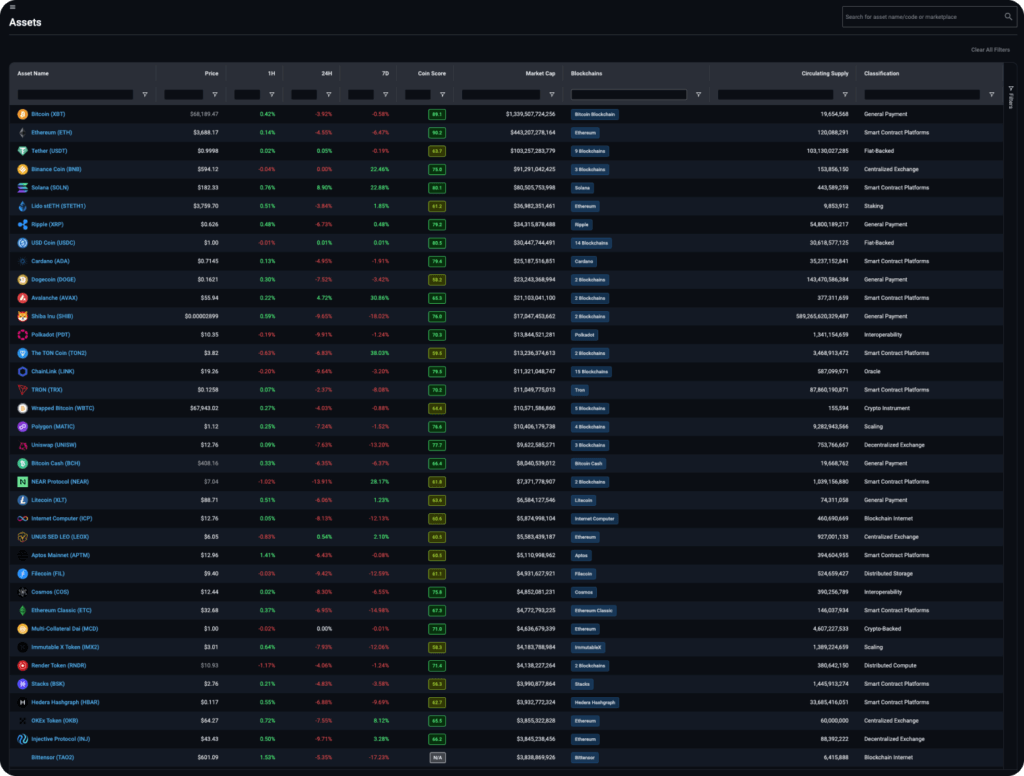

Track millions of crypto assets with real-time updates on pricing, technical details, and sustainability scores.

Dive deep into crypto trading platforms, assessing operational dynamics, regulatory compliance, and security protocols.

Access immediate information on digital assets and trading venues, keeping you abreast of the latest market movements.

Explore market trends through detailed analysis, identifying patterns and insights that guide informed crypto investment strategies.

Speak with one of our data experts and unlock the full potential of your crypto business.

Create a holistic and informed view of each crypto assets structure with data elements that cover token attribute details, supply, blockchain, governance, and sector classification. Understand the asset, from its inception to its current state, via Lukka Crypto Actions.

Navigate the crypto ecosystem with ease, thanks to clear categorizations of assets based on their primary use cases. Primary classification of the specific sector an asset or NFT falls within, based on Lukka’s proprietary Digital Asset Classification Standards (LDACS™)

Gain insights into each project’s technical governance and community governance to learn how decisions are made and how an asset interacts with its community .

Make informed decisions with Sustainability scores that evaluate the sustainability, social impact to the digital asset community, and governance practices of each project.

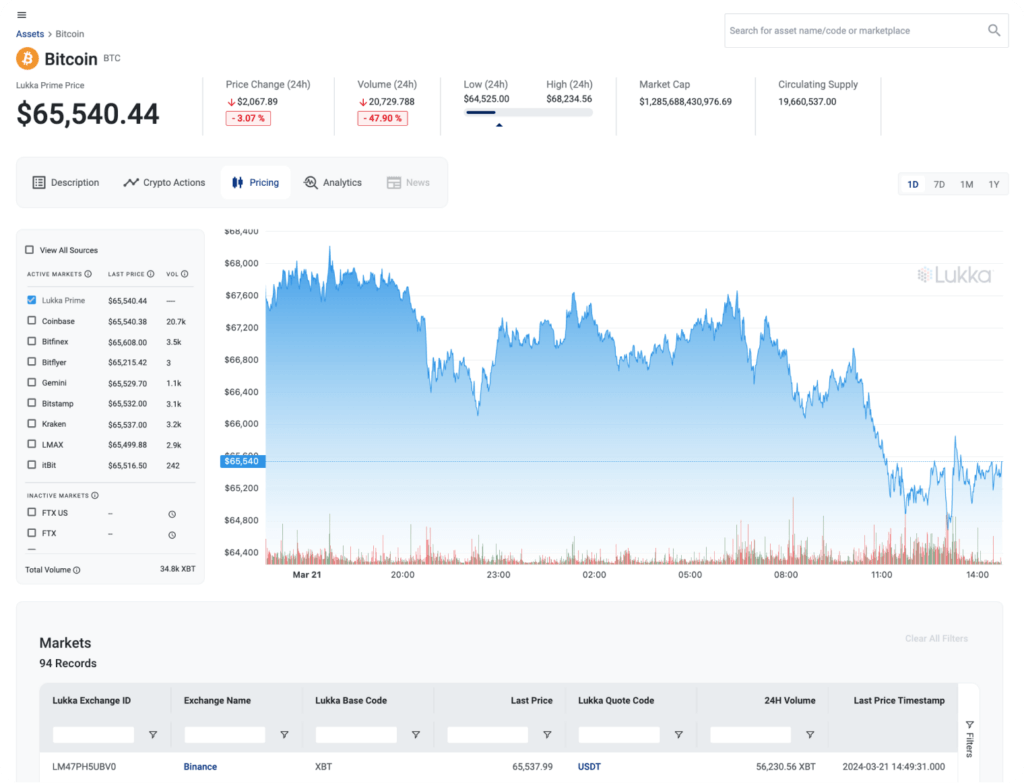

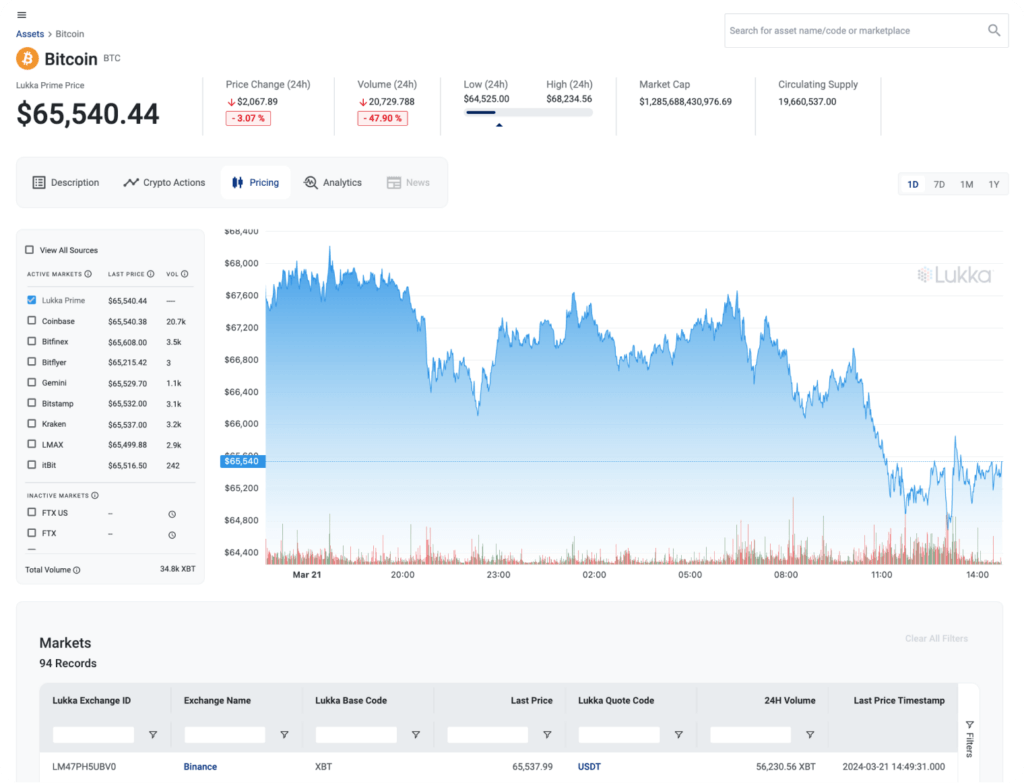

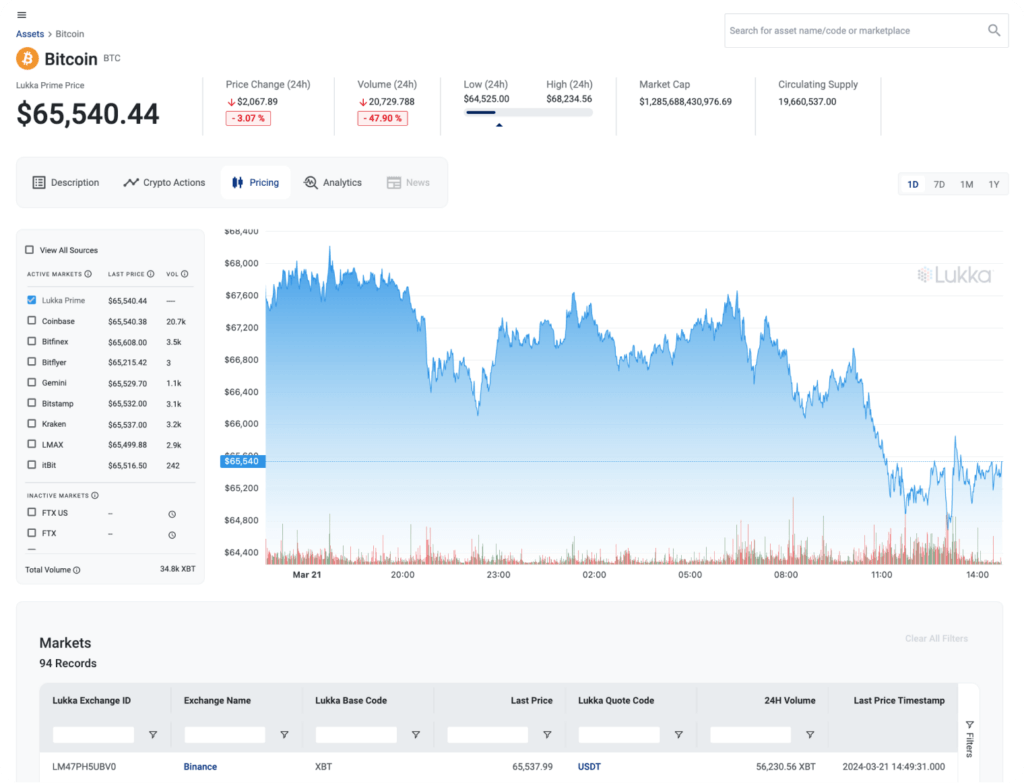

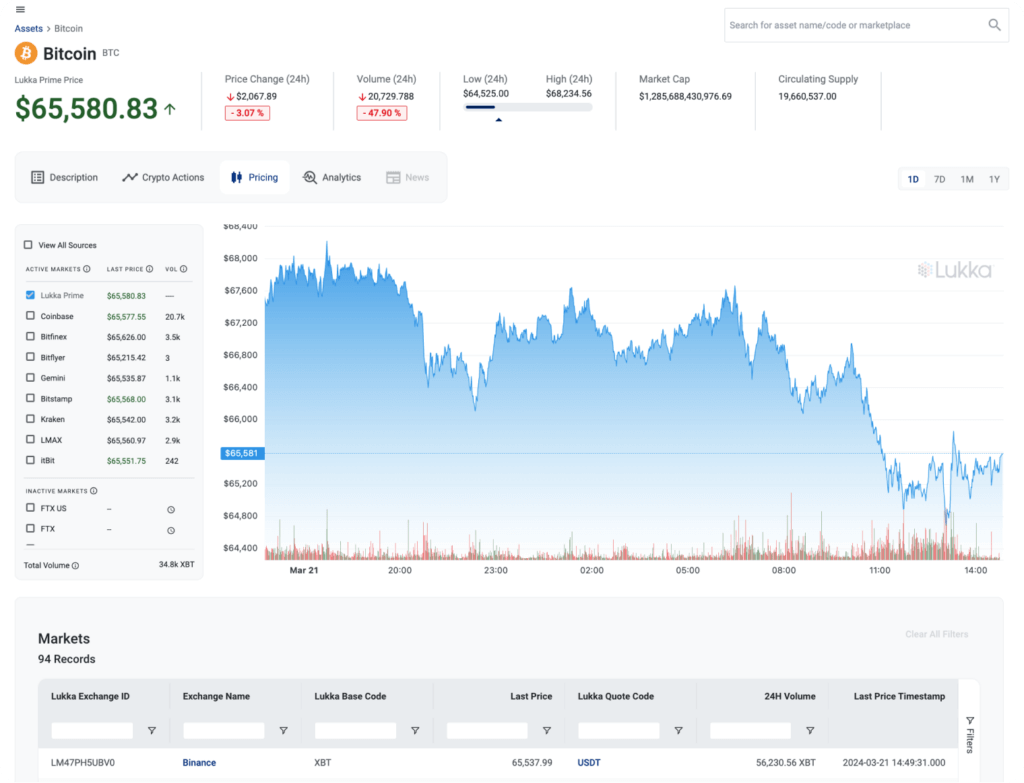

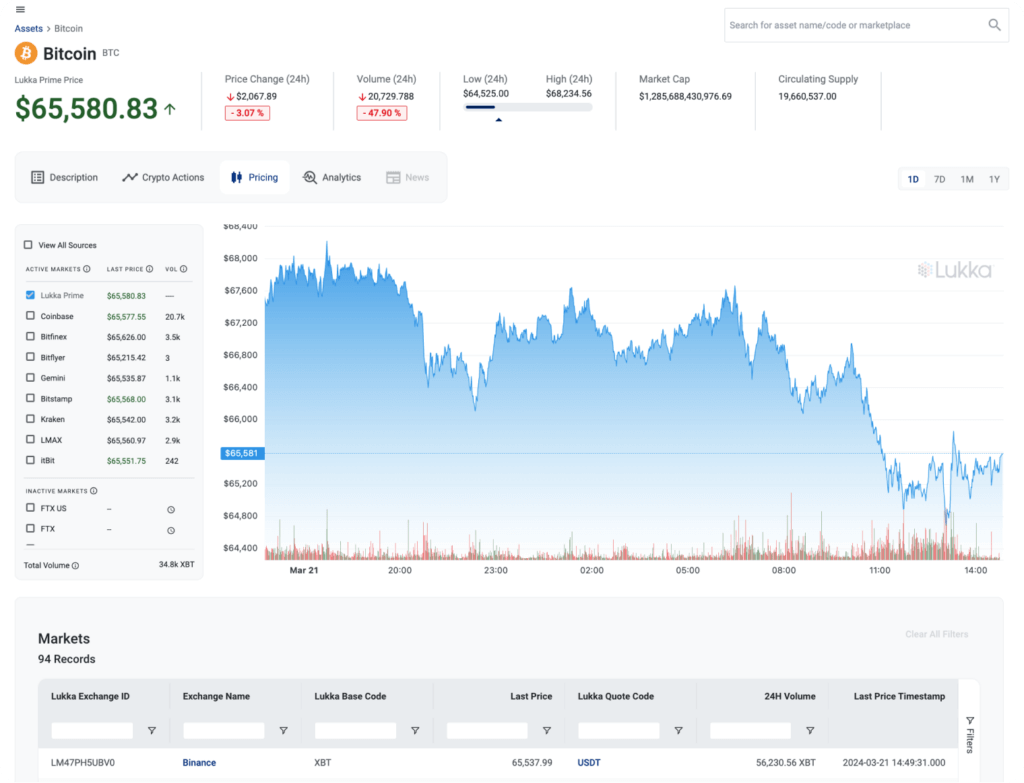

Access a concise overview of cryptocurrency financials from Lukka Prime, including historical and current prices, 24-hour changes, trading volumes, and market caps. Daily high and low prices provide snapshots of market volatility, enriching your market trend analysis.

Easily evaluate a crypto asset using our crypto asset evaluation framework driven by Lukka’s expansive digital asset security master, market data, and proprietary blockchain analytics offerings.

Stay updated on essential digital asset transformations with Lukka Crypto Actions Data, leveraging Lukka’s extensive digital asset database and proprietary blockchain analytics.

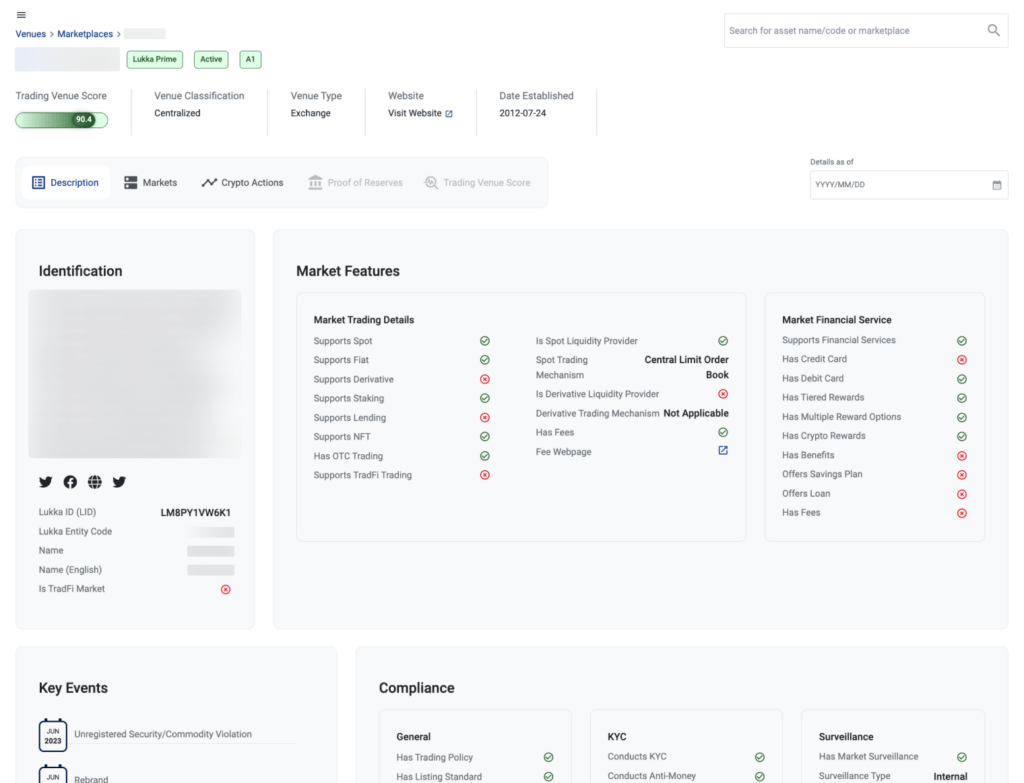

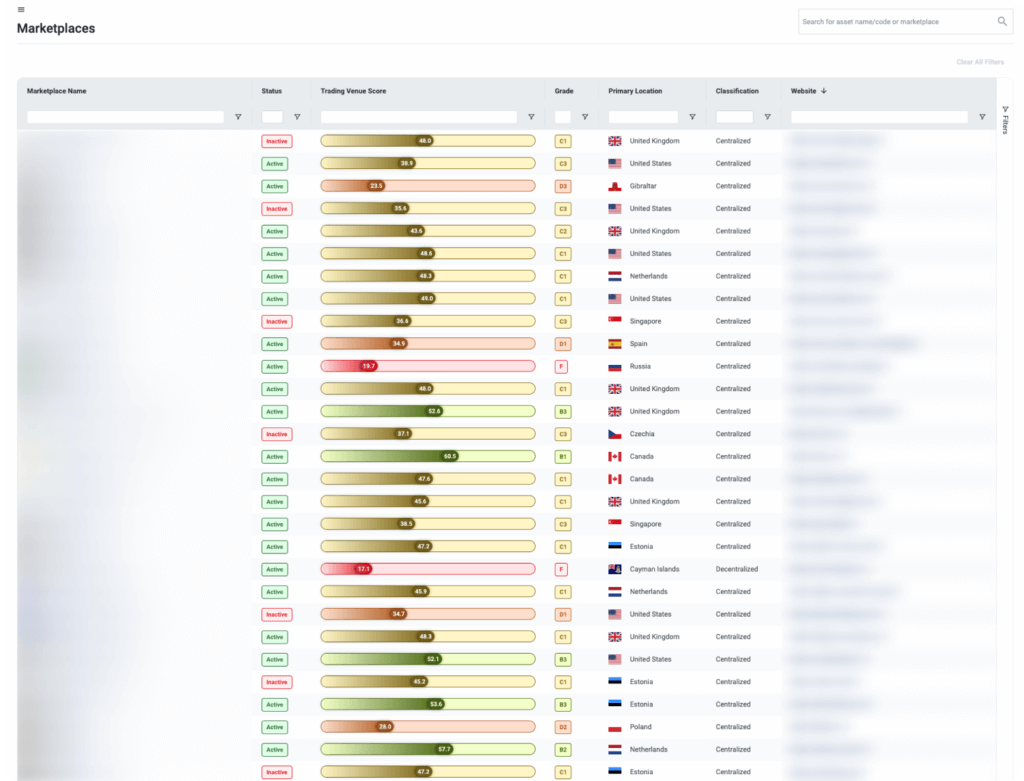

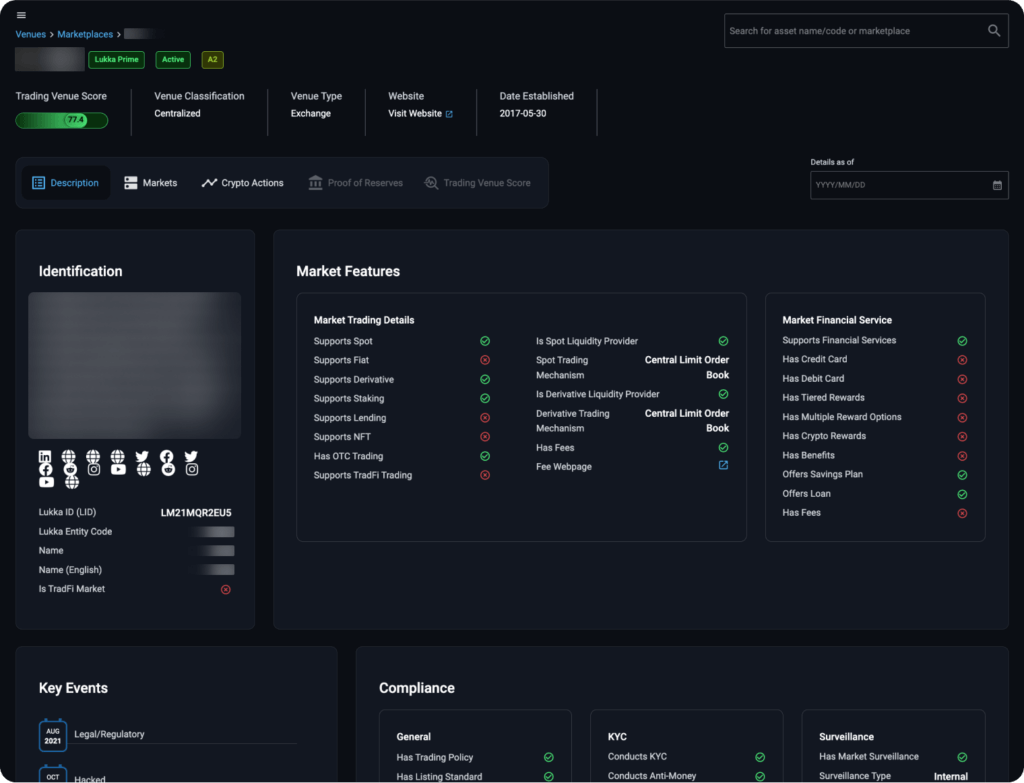

Access exhaustive profiles of crypto trading venues, including centralized and decentralized exchanges. Each profile encompasses the status, Lukka Trading Venue Scores, and venue classification to help users assess the platform’s reliability and suitability for their trading needs.

Gain insights into the integrity and quality of digital asset trading venues with the Lukka Trading Venue Score (LTVS).

Understand the technical infrastructure of trading venues, including API support, data access, and advanced trading technologies.

Explore the operational nuances of each venue, including types of markets supported (e.g., spot, derivatives, fiat integration), staking, lending capabilities, and NFT offerings.

Learn about the geographical reach and market accessibility of each venue, including jurisdictional presence and international compliance.

Gain insight into the regulatory components of each venue, with detailed information on licensing, compliance measures, and security protocols.

Delve into the security measures adopted by trading venues, including digital insurance coverage and operational risk management practices.

Gain insight into the market’s view of volatility as viewed through the lens of the options market.

Gain insight into the market’s view of interest rates as viewed through the lens of the derivatives market.

Commonly used inputs to risk models, such as beta, correlation, corvariance, and realized volatility, calculated for your specified assets and asset pairs on demand.

Find comparable digital assets in seconds, not hours…days…or even weeks!

…and hundreds more businesses.

Lukka Enterprise Data Management is right for any business involved in the crypto ecosystem. The more crypto transactions you have, the more tools and techniques are required to look over your data. Lukka Prime will solve those complex challenges for you.

Lukka Enterprise Data Management uses institutional grade data ingestion that includes 30+ APIs, 130+ pre-mapped file formats, and institutional quality node data. We also give our customers manual entry software features ensuring all data is precisely collected.

The crypto ecosystem is complex and has hundreds of exchanges, trading desks, wallets, and other businesses and there are no standard asset names, tickers, file formats, or data element formats. Lukka Reference Data solves this for you and is fully automated into Lukka’s Enterprise Data Management. Once you add all of your sources, regardless of the source or ticker, Bitcoin will be Bitcoin.

Lukka uses 50+ reconciliation reports and features to ensure completeness of data. Our Customer Success team is also available to assist your business with its data challenges.

Lukka processes your data with precision based on your needs. Lukka Reference Data maps and standardizes asset names, tickers, trading pairs, and more across hundreds of venues.

Our enterprise data management software allows you to configure your pricing feed based on standardized exchange data, design a VWAP or index calculation, and produce minute by minute, hourly, and daily price reports.