Blockchain technology has revolutionized financial systems by introducing decentralized, transparent, and immutable transactions. However, its pseudonymous nature, combined with the increasing complexity of digital asset transactions, presents new challenges for risk management, regulatory compliance, and fraud prevention – challenges that can be effectively addressed with blockchain analytics solutions.

On one hand, blockchain enables transparent financial interactions; on the other, it facilitates illicit activities such as money laundering, terrorist financing, and sanctions evasion when combined with privacy-enhancing tools like mixers and tumblers. The ability to trace transactions, assess counterparty risks, and automate compliance workflows has become a necessity for financial institutions, regulators, and crypto businesses.

Fundamentals of Blockchain Analytics

Blockchain analytics involves systematically extracting, analyzing, and interpreting blockchain transaction data to support compliance, fraud detection, and risk assessment efforts. It enables businesses and regulators to track digital asset movements, identify counterparties, and uncover suspicious financial activities.

Blockchain data analysis relies on two key components: on-chain and off-chain analytics.

On-chain analytics focuses on data that is directly recorded on blockchain ledgers, including wallet addresses, transaction hashes, smart contracts, and token transfers. By examining these records, organizations can identify ownership patterns, transaction behaviors, and wallet interactions.

Off-chain analytics incorporates external data sources such as regulatory filings, social media insights, and dark web intelligence to enhance blockchain data with real-world context. By combining both on-chain and off-chain intelligence, Lukka Blockchain Analytics enables deeper investigations into illicit fund flows and regulatory violations.

A key challenge in blockchain analytics is identifying and linking anonymous blockchain addresses to real-world entities. To address this, Lukka employs sophisticated ownership detection and clustering techniques, enabling the grouping of addresses belonging to the same entity. This methodology helps financial institutions understand their true risk exposure by connecting multiple wallets to a single organization or individual, even when ownership has been intentionally obscured..

Transaction Monitoring Techniques

Transaction monitoring is the process of continuously analyzing blockchain transactions in real-time to detect suspicious activities and enforce compliance regulations. Unlike traditional financial monitoring systems, which rely on intermediaries such as banks, blockchain transactions are direct and immutable, making proactive monitoring essential.

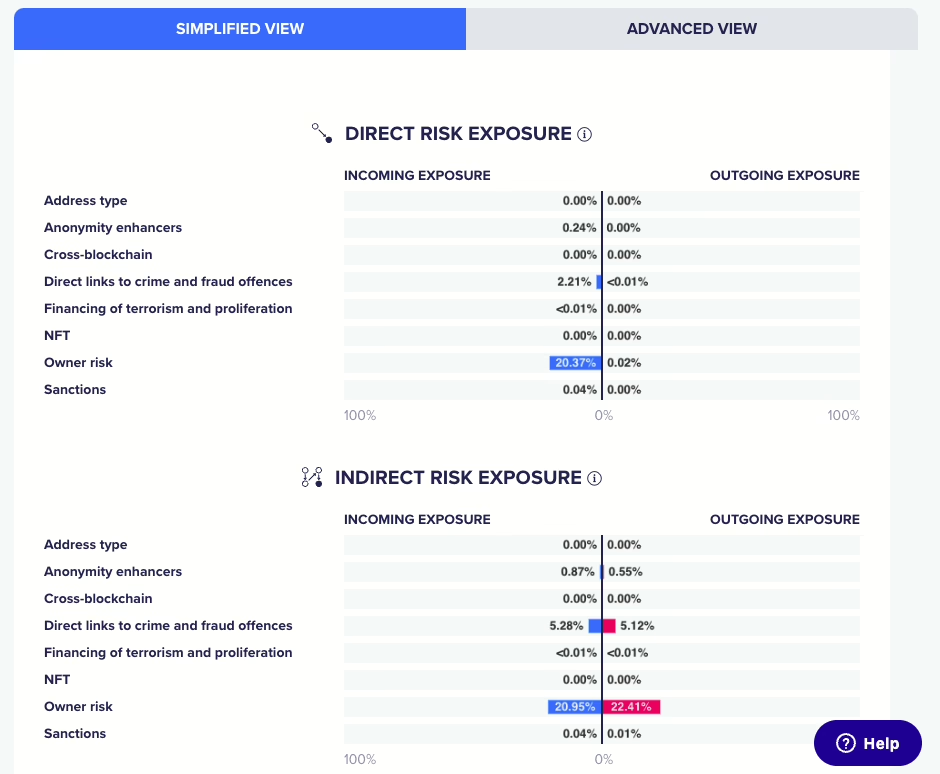

One of the primary challenges in blockchain transaction monitoring is the complexity of detecting illicit activities hidden within multi-hop transactions. Criminals use layering techniques, privacy wallets, and cross-chain transfers to obscure fund origins. Lukka Blockchain Analytics addresses this challenge by employing proprietary risk tracing and propagation algorithms (Risk Proximity Paths) propagating the risks across hundreds of transaction hops, including token swaps and cross-blockchain transactions.

Lukka’s Monitoring Panel provides a centralized dashboard that enables compliance teams to set customized alerts for activities such as large-value transfers, rapid transaction bursts, or interactions with high-risk addresses. By integrating real-time notifications, businesses can respond to suspicious activities before regulatory breaches occur.

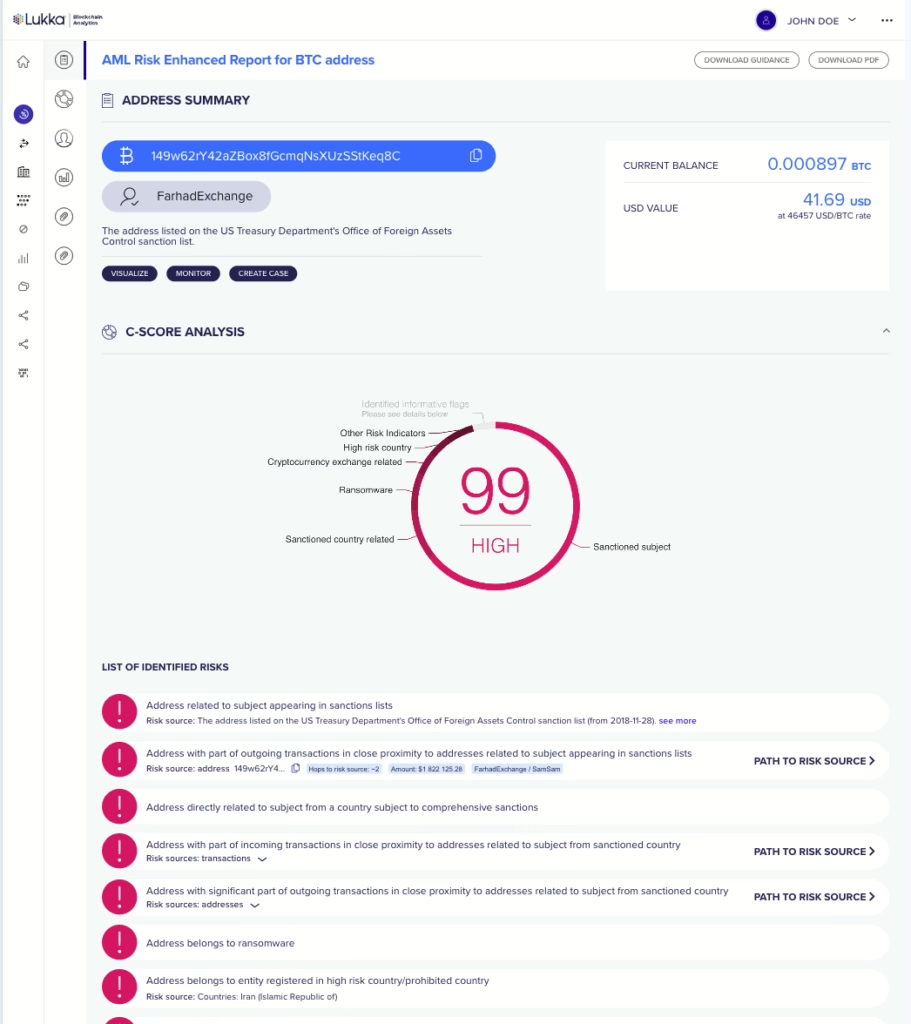

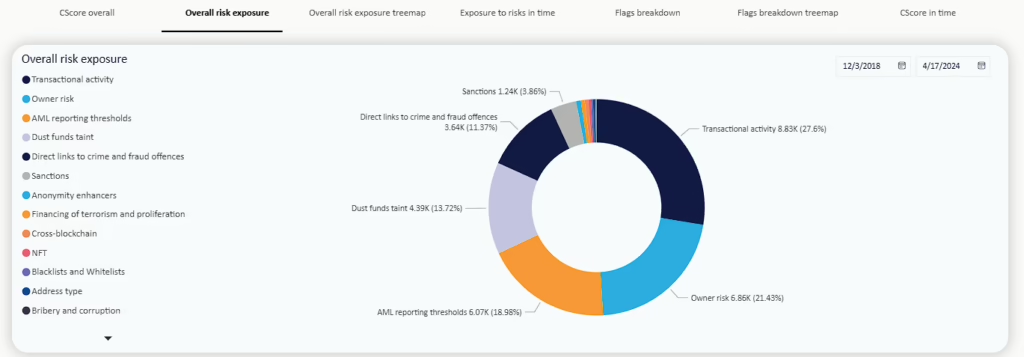

Lukka’s AML risk assessment engine applies over 380 risk assessment rules to screened transactions, identifying those linked to financial crimes such as ransomware payments, fraud schemes, and darknet marketplace activity, as well as detecting suspicious transactional activity patterns.

Regulatory Landscape and Compliance

Regulatory agencies worldwide have recognized the importance of blockchain analytics in preventing financial crime. Crypto businesses, financial institutions, and payment processors are now required to implement AML (Anti-Money Laundering) and KYC (Know Your Customer) measures, ensuring that they can verify user identities, assess risks, and report suspicious transactions.

One of the most significant regulatory frameworks impacting crypto businesses is the FATF Travel Rule, which mandates that Virtual Asset Service Providers (VASPs) share customer data for transactions above a specified threshold. Lukka’s blockchain analytics platform automates compliance with the Travel Rule by screening counterparty addresses, tracking fund movements, and ensuring adherence to global AML standards.

Regulatory approaches differ across jurisdictions. In the United States, the Bank Secrecy Act (BSA) and Office of Foreign Assets Control (OFAC) sanctions require comprehensive AML compliance for crypto exchanges and financial institutions. The European Union’s 6th AML Directive (6AMLD) has imposed harsher penalties for money laundering, while Asia-Pacific countries like Japan and Singapore require VASPs to register and comply with licensing standards.

Lukka’s Sanctions Screening engine ensures organizational compliance by automatically flagging transactions involving sanctioned entities, individuals, or those originating from sanctioned jurisdictions. Lukka’s analytical engine goes beyond screening for entities or wallet addresses directly listed on these lists; it also alerts on addresses or entities that have had any direct or indirect interaction with such entities or wallets associated.

Industry Applications of Blockchain Analytics

Cryptocurrency Exchanges and Trading Platforms

Crypto exchanges face increasing scrutiny from regulators, making AML transaction monitoring, fraud detection, and wallet risk scoring essential. Lukka Blockchain Analytics enables exchanges to assess customer risks, flag high-risk transactions, and comply with Travel Rule requirements.

Financial Institutions and Banks

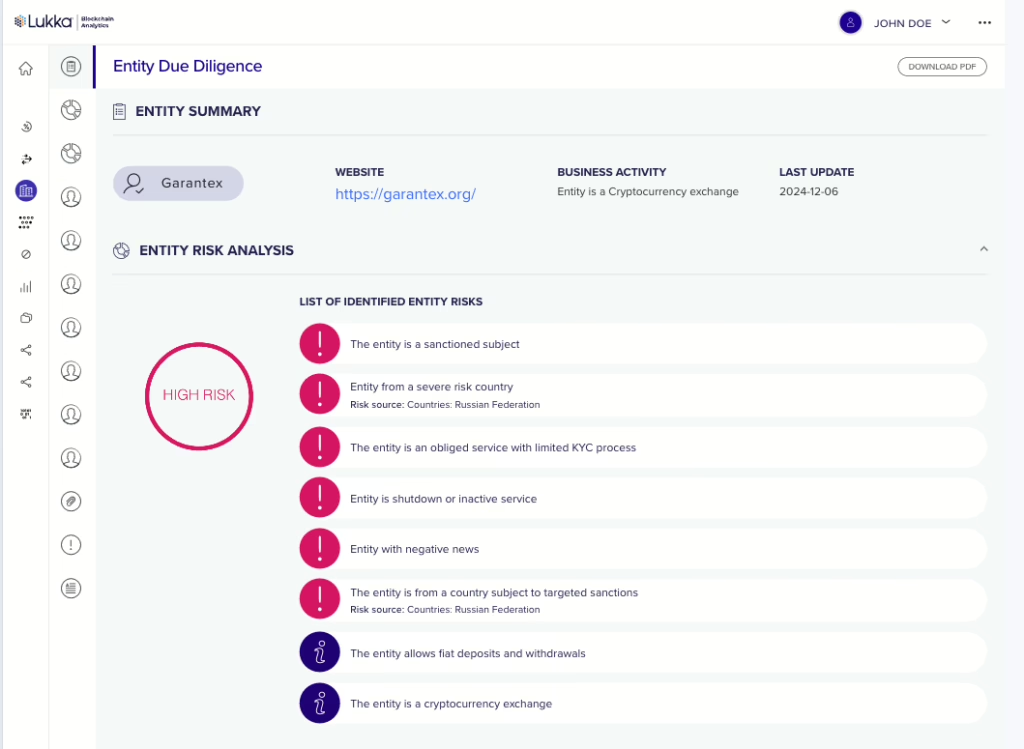

Traditional banks entering the digital asset space must conduct due diligence on counterparties, verify fund sources, and prevent exposure to illicit transactions. Lukka’s Entity Due Diligence tool provides financial institutions with real-time risk insights into VASPs on-chain activity and risks related, counterparties, blockchain transactions as well as detailed regulatory/licensing information..

Law Enforcement and Forensic Investigations

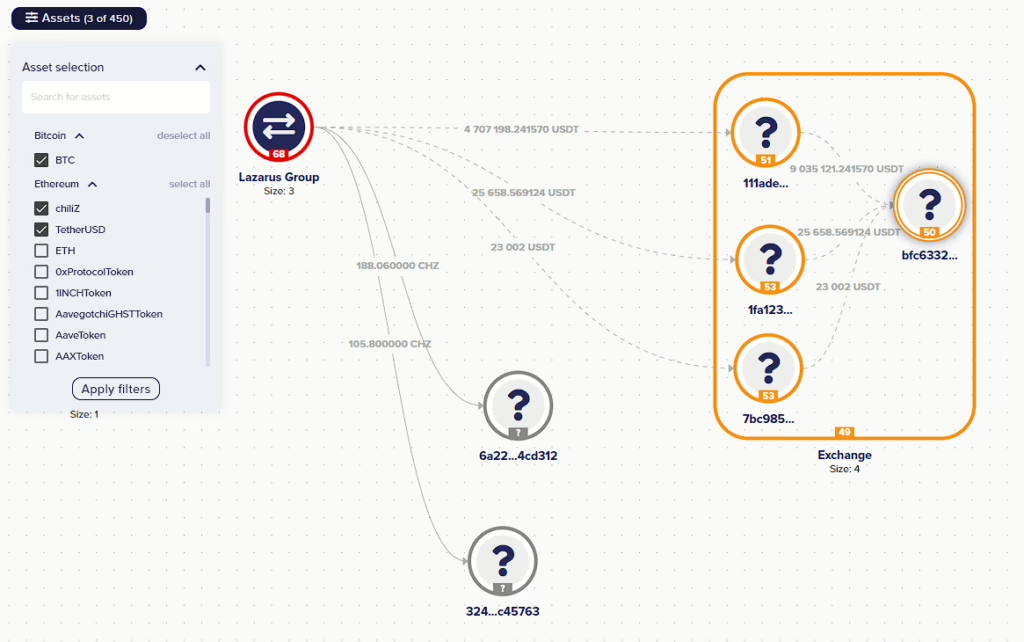

Regulators and law enforcement agencies leverage Lukka’s forensic tracking capabilities to trace illicit transactions, identify criminal networks, and recover stolen assets. The OMNI tool and Blockchain Investigator provide automated fund tracing and evidentiary reporting for legal proceedings.

Lukka Blockchain Analytics

Lukka Blockchain Analytics is a comprehensive SaaS platform designed for fraud detection, regulatory compliance, and blockchain forensic investigations. It enables real-time transaction monitoring, risk scoring, and entity profiling to help businesses and regulators navigate compliance challenges.

With support for over 1.8 million digital assets and more than 100 blockchains and protocols, Lukka provides the broadest blockchain analytics coverage in the market, making it a leader in institutional blockchain risk management.

Lukka Blockchain Analytics features:

- AML Risk Reports: Generates detailed risk assessments of wallets, transactions, and counterparties using over 380 risk indicators.Automated Risk.

- Source Tracing: Identifies the ultimate origin of illicit funds through multi-hop transaction tracing.

- OMNI Tool: Provides graph-based transaction tracking to map out illicit fund flows and identify money laundering patterns.

- AML Risk Reports: Generates detailed risk assessments of wallets, transactions, and counterparties using over 380 risk indicators.Automated Risk.

- Entity Due Diligence: Evaluates the compliance status, AML/KYC practices, and licensing of over 40.000 businesses worldwide.

- Sanctions Screening: Helps to check whether a blockchain address is on a sanctions list.

- Monitoring Panel: Tracks blockchain addresses in real-time and alert users to suspicious activities based on predefined risk parameters.

- Entity Due Diligence: Evaluates the compliance status, AML/KYC practices, and licensing of over 40.000 businesses worldwide.

Lukka Transaction Monitoring API – A Market-Leading Solution for Real-Time AML Risk Screening

Lukka’s Transaction Monitoring API for Deposits/Withdrawals is one of the most advanced solutions available for integrating real-time AML risk screening into transaction processing workflows. Designed for financial institutions, cryptocurrency exchanges, DEXes, ATM operators, custodians, and non-custodial wallet providers, the API ensures comprehensive monitoring of deposits and withdrawals, helping institutions stay ahead of potential risks while maintaining efficient asset management.

Lukka Blockchain Analytics features:

- Real-Time Transaction Screening: The API scans transaction hashes and counterparties, identifying potential AML risks and compliance violations.

- High-Performance API: A synchronous REST API service that seamlessly integrates into client transaction processing systems, allowing for instant risk evaluation.

- Automated Alerts & Decision-Making: Institutions can automate fund processing decisions, either crediting client accounts instantly or holding transactions for further investigation when risk alerts are triggered.

- Advanced Risk Evaluation: Uses proprietary AML scoring models, enhancing proximity risk detection and geographic risk indicators while excluding false positives from behavioral anomalies.

- Customizable Risk Controls: Supports pre-screening for withdrawal attempts, allowing businesses to block transactions to high-risk addresses before execution.

- Real-Time Transaction Screening: The API scans transaction hashes and counterparties, identifying potential AML risks and compliance violations.

By integrating Lukka’s Transaction Monitoring API, institutions gain market-leading risk intelligence, ensuring compliance, fraud prevention, and secure asset management while minimizing exposure to financial crime.

Emerging Trends and Future Directions

As blockchain technology develops, analytics solutions must adapt to new risks and compliance challenges. Lukka is at the forefront of addressing emerging threats in cross-chain finance, DeFi, NFTs, and Layer 2 networks.

Cross-chain analytics has become increasingly important as bad actors exploit cross-chain bridges to move illicit funds. Lukka’s tools now trace transactions across multiple blockchains to detect laundering patterns and identify risk exposures.

With the growth of Layer 2 scaling solutions such as Optimism and Arbitrum, maintaining transaction visibility has become a challenge. Lukka’s analytics tools are being enhanced to monitor Layer 2 interactions, detect anomalies, and ensure AML compliance.

Building an Effective Blockchain Monitoring Strategy

1

Establish a risk-based transaction monitoring framework.

2

Automate AML screening and regulatory reporting.

3

Leverage forensic tools for detailed investigations.

4

Integrate AI-driven risk assessments to reduce false positives.

Blockchain analytics has become an indispensable tool for regulatory compliance, financial security, and risk management. Lukka’s advanced monitoring and investigative solutions empower businesses, financial institutions, and regulators to detect financial crime, enforce compliance, and secure digital asset ecosystems.

By leveraging Lukka Blockchain Analytics, organizations can enhance security, streamline regulatory compliance, and stay ahead of evolving risks in the crypto landscape.

Streamline your crypto compliance today

Ensure regulatory compliance and mitigate financial risks with Lukka’s industry-leading blockchain analytics and transaction monitoring solutions. Streamline your crypto compliance today with real-time AML screening, risk assessment, and forensic investigation tools.

Book a demo