Why Financial Institutions Must Rethink Their Approach to Digital Asset Accounting

The financial industry is undergoing a major transformation as digital assets become a core component of institutional portfolios. CFOs, accountants, and financial controllers across banks, asset managers, hedge funds, and crypto-native firms face growing regulatory scrutiny and increasing pressure to apply rigorous financial reporting standards to these assets. Ensuring audit readiness, regulatory compliance, and financial accuracy is now a critical priority.

Unlike traditional financial markets with set trading hours, digital assets operate around the clock across both centralized and decentralized platforms. This fluid trading environment introduces unique challenges, including market fragmentation, heightened price volatility, and the absence of standardized accounting frameworks. Financial institutions must adapt to a 24/7 ecosystem where transactions span multiple blockchains, exchanges, and custodial solutions—each with distinct reporting structures and valuation methodologies.

To address these challenges, global regulators are introducing clearer guidelines on valuation, reporting, and financial disclosures for digital assets. Institutions must adapt quickly to meet these standards while maintaining operational efficiency and accuracy.

Regulatory Clarity is Driving Change

In the United States, the SEC’s SAB 122, issued on January 23, 2025, represents a major step forward in financial reporting for crypto assets. Unlike its predecessor, SAB 121, which introduced unconventional methodologies, SAB 122 aligns reporting entities with well-established U.S. GAAP and IFRS frameworks. This shift enhances transparency and standardization in digital asset reporting.

Beyond the U.S., financial institutions are adapting to regulatory requirements such as Europe’s MiCA (Markets in Crypto-Assets Regulation), Basel Committee standards for crypto risk weighting, Japan’s FSA digital asset reporting framework, and Singapore’s MAS regulatory framework. These new compliance mandates reinforce the need for automated, compliance-driven solutions that ensure jurisdiction-specific financial reporting accuracy and operational efficiency.

The Challenge: Data Fragmentation and Manual Accounting Workflows

Digital asset transactions often occur across multiple trading venues, each using different pricing models, reporting standards, and settlement structures. This results in:

- Data fragmentation – Institutions face challenges in aggregating transactional data from multiple sources into a unified, accurate view.

- Reconciliation inefficiencies – Transaction mismatches between books and records create discrepancies that require manual intervention.

- Regulatory compliance risks – Financial reporting must align with jurisdiction-specific requirements while ensuring audit readiness.

To address these challenges, financial professionals require institutional-grade solutions that automate data ingestion, reconciliation, and financial reporting, ensuring accuracy, efficiency, and compliance.

How Lukka Solves These Challenges with Institutional-Grade Accounting Solutions

1. Seamless Data Ingestion & Aggregation

To ensure accuracy and compliance, financial institutions require a centralized, real-time source of digital asset data. Lukka Enterprise Software eliminates data fragmentation by integrating with 100+ blockchains, trading venues, and custodians, providing a single source of truth for digital asset reporting.

How It Works:

- Blockchain Wallet Tracking – Sync on-chain transactions in real time by entering a wallet address, ensuring full visibility into asset balances and transaction history.

- Exchange API Connectivity – Securely integrate read-only API keys for direct, automated data ingestion from centralized exchanges.

- Automated & Manual Data Uploads – Institutions can manually upload CSV files or automate ingestion via SFTP and cloud-based integrations, ensuring continuous, real-time data capture.

With a single source of truth, Lukka helps financial teams to reduce reconciliation risks, improve reporting accuracy, and enhance operational efficiency.

2. Automated Reconciliation: Ensuring Complete & Accurate Financial Data

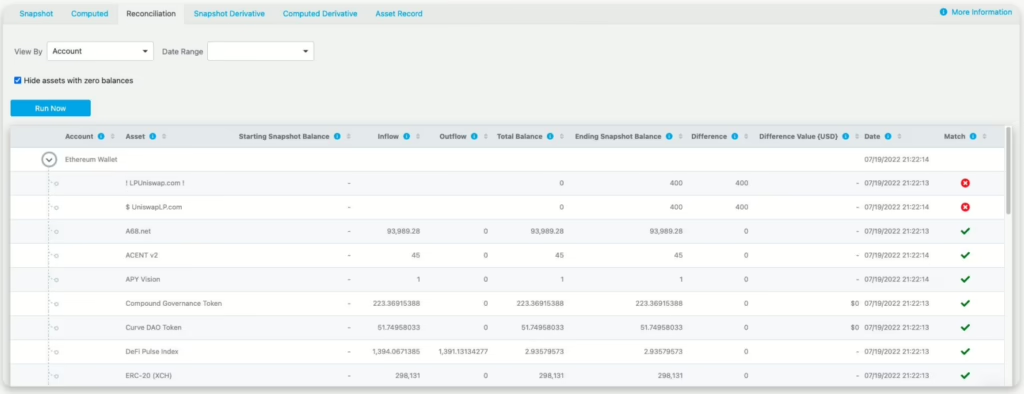

Digital asset transactions require continuous reconciliation due to price variations, non-standard settlement times, and differing transaction fees across trading venues. Lukka’s Automated Reconciliation Engine ensures that financial records remain accurate, complete, and audit-ready.

How It Works:

- Snapshot API Balance – Retrieves exchange-reported balances and blockchain holdings, for real-time verification.

- Lukka-Computed Balance – Aggregates inflows and outflows to calculate expected balances, ensuring reconciliation accuracy.

- Discrepancy Resolution & Alerts – Flags mismatched balances, allowing financial teams to investigate discrepancies, correct errors, and verify missing transactions.

By automating reconciliation, institutions eliminate manual processes, reduce audit risks, and maintain fully reconciled financial records—ensuring compliance and operational efficiency.

Use our 50+ reconciliation reports and features or ask our Customer Success team to do it for you.

The unique data characteristics of crypto asset transactions add new complexity to your back-office.

At Lukka, we use traditional and proprietary techniques to detect and solve data breaks.

3. Standardized, Auditable Transactions: Institutional-Level Accuracy

Digital asset platforms often use inconsistent tickers, trade classifications, and fee structures, leading to misclassified transactions and reporting inconsistencies. Lukka standardizes and normalizes financial data, ensuring institutional-grade accuracy in digital asset reporting.

How It Works:

- Ticker Standardization – Maps all digital asset symbols to a single, authoritative identifier, eliminating inconsistencies across exchanges.

- Trade Categorization – Automatically classifies trades, transfers, staking income, loans, and derivatives based on predefined accounting rules.

- Audit Logs & User Controls – Every transaction edit, adjustment, and correction is timestamped and permission-controlled, ensuring full audit traceability.

With Lukka’s transaction standardization framework, institutions can confidently generate accurate, GAAP-/IFRS-aligned financial reports.

Correctly price assets and ascertain Fair Market Value (FMV) with Lukka Pricing Data, built to provide institutional level valuation for crypto assets covering:

- 10,000 Trading Pairs

- 27 Exchanges

- 90,000,000,000 Trading Ticks

Automatically Standardized with integrated Lukka Reference Data, which normalizes your ticker symbols and other data formats across over:

- 320,000+ Crypto Spot Assets

- 400,000+ Crypto Derivatives

- 500+ Exchanges and Other Sources

- 48,000+ Unique Crypto Trading Pairs

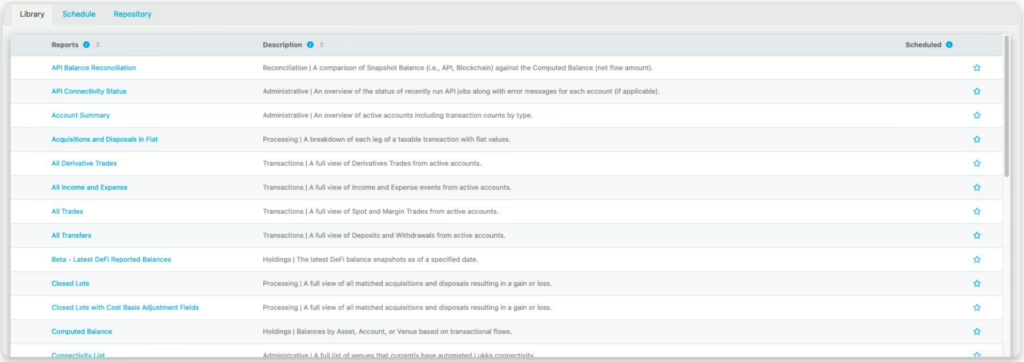

4. Financial Reporting & Compliance: A Global Standard for Digital Asset Accounting

Lukka provides 100+ pre-configured reports tailored for institutional digital asset management, enabling financial teams to ensure audit readiness and regulatory compliance.

Key Reports Include:

- All Transactions Report – A complete ledger of all digital asset movements across accounts.

- Computed Balance Reports – Ensures end-of-period balances align with reconciled records.

- Fee Analysis by Account – Tracks trading fees, withdrawal fees, and gas fees across platforms.

- Taxable vs. Non-Taxable Transactions Report – Differentiates income sources for crypto tax and regulatory compliance.

- Ledger Reconciliations – Aligns financial statements with sub-ledger records and external reporting requirements.

By integrating with ERP systems such as NetSuite, SAP, and other financial platforms, Lukka ensures that financial data seamlessly integrates into enterprise accounting workflows.

Why Lukka is the Preferred Solution for Institutional Digital Asset Accounting

Financial institutions require automated, scalable solutions that enable them to maintain compliance while optimizing financial reporting. Lukka delivers:

GAAP-/IFRS-Aligned Fair Market Values

Ensuring compliance with global financial reporting standards.

Integrated 1099-DA & CARF Reporting

Supporting tax and regulatory disclosure obligations.

Automated Reconciliation & Audit-Ready Reports

Eliminating manual reporting inefficiencies.

Enterprise ERP Integration

Seamlessly supporting NetSuite, SAP, and other financial systems.

Streamline your crypto operations today

Ensure compliance, accuracy, and efficiency in digital asset accounting with Lukka’s institutional-grade solutions. Automate data ingestion, reconciliation, and reporting to meet SAB 122 and global regulatory standards.

Book a demo