Principal Market Identification and Beyond

Updated October 2022

Author: Suzanne Morsfield, Global Head of Accounting Solutions in Data & Analytics

The FASB just approved fair value accounting for specific crypto assets – Lukka’s ready, are you?

In its October 12, 2022 meeting the Financial Accounting Standards Board (FASB) voted unanimously to require fair value accounting for specific types of crypto assets. While this requirement may be new to some, Lukka has been rigorously supporting this accounting methodology for years, enabling its customers to pass their audits, whether they are striking NAV, marking to market, or testing for impairment. Underneath the hood of our fair value methodology is a foundation of high-quality data and a classification system that permits customers to further understand the types of crypto assets they are considering or are already holding–further, our data classification system allows us to help you assess whether a particular crypto asset is likely to be within scope for the new fair value requirement. And, for any crypto assets that are not within scope, Lukka’s impairment product facilitates daily, monthly, quarterly, or annual impairment testing and calculation at the push of a button.

Why do we need to talk about fair value for crypto assets?

The role of crypto assets in the global economy is both growing and evolving on an exponential scale. And whether a reporting entity (for-profit or not-for-profit) is simply holding these assets as investments, or using them in transactions, chances are the accounting concept of fair value will be applicable at some point in their financial reporting year. It is important to talk about fair value accounting because this accounting concept, and its measurement, can be mandatory for elements of a reporting entity’s financial statements and related disclosures. The requirement may be relevant for financial statement items that everyone recognizes, such as investments in publicly-traded securities; it can be equally important for the ongoing accounting valuation of items like a company’s trademarks or its crypto assets.

In a nutshell, fair value is a measurement approach that defines what to include or not in the reported amount of an asset in a company’s financial statements. However, it generally is not the same valuation as that performed by sell-side analysts. For accounting purposes, fair value measurement typically resides on a continuum–on one end there may be a relatively precise measure, driven by observable prices from a public exchange, and on the other end may be an estimation consisting of a model with inputs that are not publicly available.

Regardless of where fair value falls on the continuum, the exact measurement of it, as discussed here, is confined by the guardrails put in place by global accounting standard-setters and regulators. Sometimes this guidance is very prescriptive, and other times, it may offer only principles. But, in all cases, reporting entities usually will need to find a path through the accounting fair value framework if they hold or use crypto assets. The discussion that follows provides some insights into that journey.

Can crypto assets be reliably valued under existing accounting standards?

This question has been puzzling to many in the financial reporting community, some of whom may wonder if the only way to value actively-traded crypto assets is by paying for custom valuation reports for each asset held or traded. The reasons for asking are valid and worth discussing. Lukka Prime answers these questions for actively-traded crypto assets with an institutional grade, AICPA SOC-certified, off-the-shelf, reasonably-priced commercial software product aligned with ASC 820 (US GAAP) and IFRS 13 (international). Its 5-step methodology has been reviewed and over the years used by top-tier academics, financial, accounting, and audit professionals.

Just how challenging is the crypto ecosystem for financial reporting?

Among other statistics that illustrate the vastness and complexity of the crypto ecosystem, Lukka’s Reference Data product comprises:

- 348+ Data Sources (e.g., exchanges, OTC desks, pricing sources)

- 100,000+ Crypto Spot Assets

- 85,000+ Trading Pairs mapped

In addition to encountering this sheer volume and variety, imagine estimating fair value and providing a reliable audit trail in markets that:

- never close

- aren’t regulated

- include assets that can’t be directly turned into fiat currency

- vary as to quality and volume/frequency of trades

- importantly, variation can also occur within a market-i.e., the volume or frequency can change dramatically on a given exchange intra-day, not to mention daily.

But, what about existing accounting standards?

To no one’s surprise, the challenges of the crypto ecosystem create additional challenges for financial reporting, and for calculating fair value. Accounting standards for crypto assets are currently under consideration by global standard-setters and regulators; however, new or improved standards have not yet been formally addressed in an authoritative way.

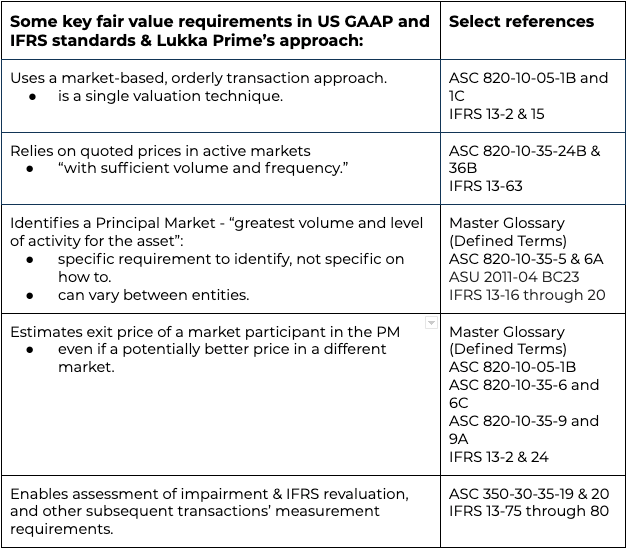

Meanwhile, many (including Lukka) believe that whenever crypto assets need to be valued, re-valued or impaired, existing fair value accounting standards are typically sufficient for most crypto assets. We list just some of the key requirements (and select references) by which Lukka Prime’s methodology aligns for actively-traded crypto assets here:

The challenges of the crypto ecosystem can further imply that technology and industry expertise are needed in order to provide a reliable valuation. Lukka provides both of these via its proprietary, but readily-available 5-step methodology.

What is the Lukka Prime 5-step Methodology?

Our 5-step process dynamically identifies a Principal Market (per current accounting standards). The methodology then uses prices from that market to calculate fair value. These steps are followed by extensive oversight and monitoring of the data coming from the exchanges and through our own processors:

- Steps 1 – 4 identify the Principal Market for actively-traded crypto assets by ranking the credibility and quality of each exchange (market) that meets our standards for governance and qualitative indicators (12+ at present); we use a dynamic proprietary ranking methodology based on volume and frequency of trades to identify the Principal Market for a particular actively-traded crypto asset or asset pair at a specific time.

- Step 5 identifies a Fair Value-based Exit Price, using the price for an actual transaction on this Principal Market at the specified point in time. This step then calculates fair value as exit price multiplied by quantity.

- To ensure the quality of each Valuation, we constantly assess the prices and exchanges for data quality (e.g., volume, outliers, deviations, transparency, manipulation, etc); this monitoring is across the entirety of the data, is not a sampling technique, and is supported by a robust Pricing Integrity Oversight Board.

And, how exactly does Lukka Prime identify a Principal Market?

Our description of the challenges of the crypto asset ecosystem notes some of the specific challenges that make valuation under current accounting rules a further challenge. Identifying a reliable and auditable Principal Market is where the rubber really meets the road on this front; it is also the concept where most of the concerns lie about whether the current standards can actually be used effectively.

In part, the way the ecosystem functions contributes to Principal Market identification concerns–i.e., if the volume and frequency of transactions can vary widely intra-day and across many exchanges for the same asset pair or asset, then how can a Principal Market possibly be identified? These questions led Lukka to co-sponsor data-driven research, now published in a peer-reviewed accounting academic journal. The study provided a rigorous, technology-based, and dynamic identification process.

Who needs Lukka Prime?

Lukka Prime is relevant and effective for any reporting entity where a fair value is needed for transactions or holdings involving actively-traded crypto assets. Many discussions about accounting valuation of crypto assets begin and end with talking about figuring out what a particular holding is worth on the financial statements. However, crypto assets also can be used in a variety of subsequent transactions, from purchases to loans to staking and everything in between.

Lukka Prime is a valuable tool for our customers for calculating fair value at each step of their crypto asset journey under current accounting standards. Some examples of what our method can assist with now include:

- Fair value of crypto asset holdings under the new FASB requirement

- Mark-to-market valuations and gains/losses

- Impairment loss assessments and reporting

- Revaluation calculations

- Purchases or sales using crypto holdings

- Crypto derivatives pricing

- DeFi transactions that require accounting valuations

- Fair value or basis for tax purposes.

Lukka supports the global standard-setting and regulatory bodies as they grapple with financial reporting answers. Our products will serve our customers’ needs whatever the direction and timing of their decisions.