Japan has just made history.

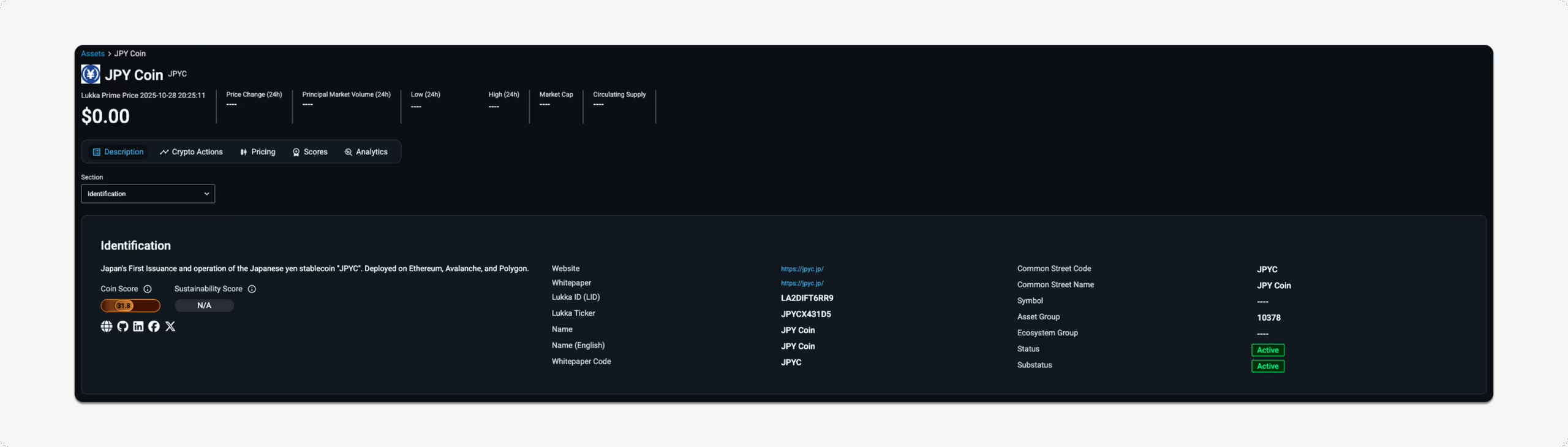

The country’s Financial Services Agency (FSA) has approved its first yen-pegged stablecoin, JPYC, ushering in a new era for regulated digital assets in one of the world’s most advanced financial markets.

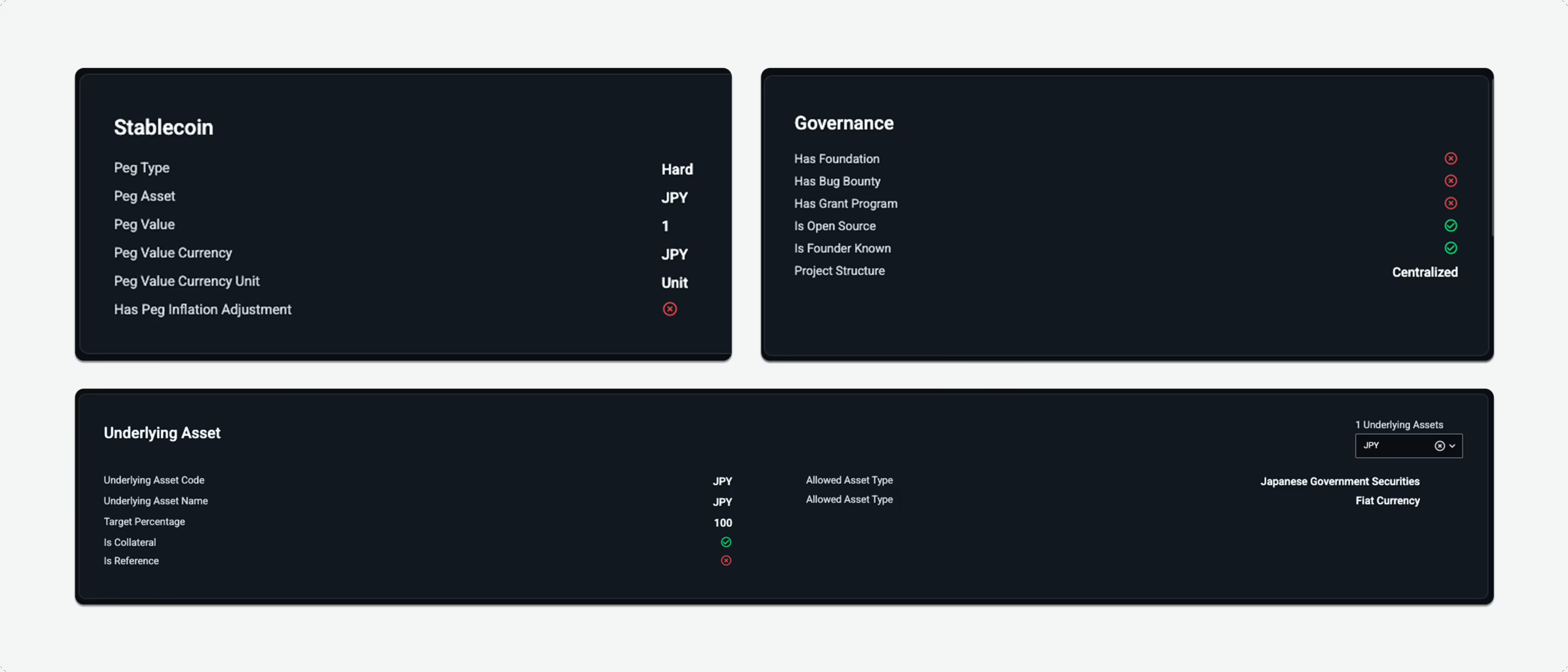

Unlike algorithmic or unregulated tokens of the past, JPYC is designed to operate under Japan’s amended Payment Services Act, which regulates the issuance and custody of fiat-backed stablecoins. The framework requires full reserve backing, licensed custodianship, and strict segregation of customer assets, ensuring JPYC is both compliant and transparent. The result: a fully regulated, asset-backed stablecoin that combines the speed of blockchain with the reliability of traditional finance.

A Turning Point for Stablecoins and Institutional Adoption

Stablecoins like JPYC are quickly becoming the connective tissue between traditional finance (TradFi) and digital finance (DeFi).

For institutions, they are not just digital payment tools, they are programmable financial instruments that unlock faster settlement, improved liquidity, and lower operational costs.

JPYC’s approval demonstrates how stablecoins can exist within a fully regulated framework, setting a global precedent for compliance, transparency, and interoperability.

In practical terms:

- Cross-border transactions can settle in seconds, not days.

- Stablecoins enable faster, more efficient international payments – helping corporations optimize liquidity and minimize foreign exchange costs.

- Investors gain access to stable, compliant digital assets tied to sovereign currencies.

Japan’s approach, anchoring JPYC to real reserves and strict FSA oversight, sets a new benchmark for regulated finance worldwide: privately issued, institutional-grade digital payment instruments backed by real-world assets.

Powering the Future of Regulated Digital Assets: Lukka’s Role

Behind every regulated stablecoin and tokenized asset lies a foundation of trusted data, audit-grade valuations, and regulatory compliance infrastructure.

That’s where Lukka steps in.

As the Digital Asset Data Operating System, Lukka powers the data, pricing, and compliance infrastructure trusted by the world’s leading institutions, auditors, and regulators.

From stablecoin issuers and tokenization platforms to custodians, fund administrators, and regulatory bodies, Lukka provides the systems that make this new asset class work – securely, transparently, and at scale.

How Lukka Enables Regulated Stablecoins and Tokenized Markets

1. Fair Market Value Pricing with Lukka Prime

- GAAP and IFRS-aligned valuations for stablecoins, tokenized funds, and RWAs.

- Compliant tax reporting for all digital assets that are not yet deemed money or currency under local or global tax reporting.

- Delivers real-time, executed prices from verified principal markets – no synthetic averages.

- Trusted globally by auditors, fund administrators, and data providers like Bloomberg and Invesco.

- Covers 4,500+ assets and 18+ vetted exchanges, supported by 10+ years of historical data.

💡 Institutions can use Lukka Prime to generate accurate, real-time fair market value prices for digital assets, helping ensure valuations are transparent, consistent, and audit-ready in alignment with GAAP and IFRS 13 standards.

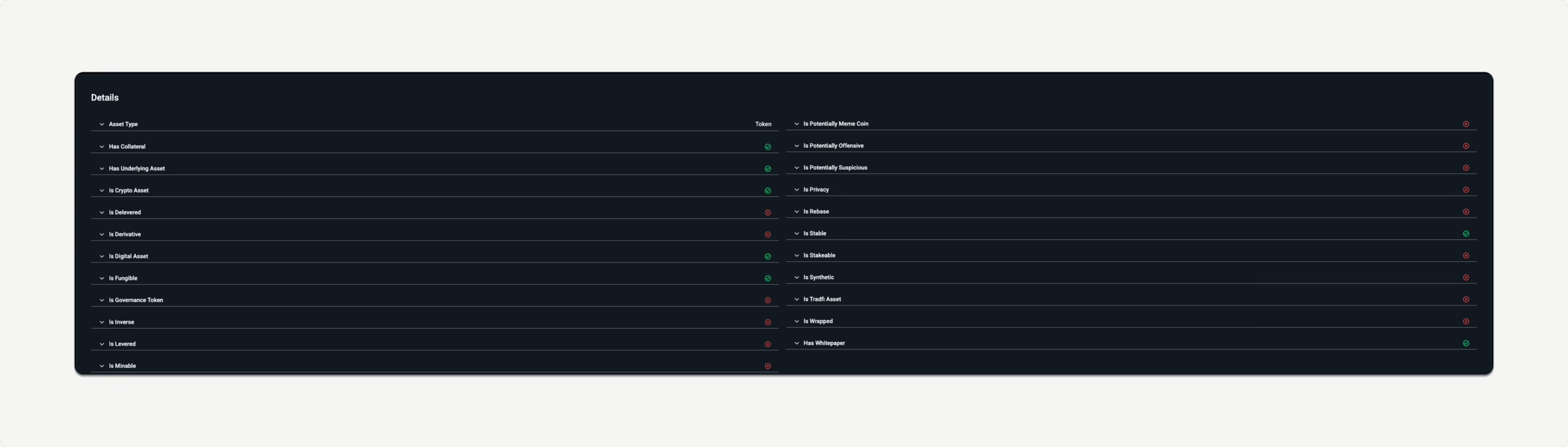

2. Comprehensive Reference Data & Classification

- Tracks 1.5 million+ assets and 17,000+ VASPs (Virtual Asset Service Providers).

- Maps tokens to their legal issuers, trading venues, and jurisdictional details, vital for regulated stablecoins and real-world asset tokenization.

- Standardized classifications identify if a token represents a stablecoin, security, commodity, or utility asset.

💡 Enterprises can use Lukka Reference Data to maintain a single, accurate source of truth for all digital asset terms and conditions.

This ensures every token, issuer, and venue is correctly classified and mapped – supporting regulatory compliance, portfolio management, and risk analysis across multiple regions.

3. Tokenization Infrastructure

- Integrates NAV synchronization, accounting hooks, and AML controls directly into the issuance process.

- Built to ensure consistency between on-chain smart contracts and off-chain financial records.

💡 Financial institutions can use Lukka’s tokenization infrastructure to issue and manage tokenized assets or stablecoins with real-time valuation and compliance built in.

This enables NAVs, pricing data, and audit reports to stay synchronized across both traditional financial systems and on-chain environments, ensuring consistency and trust.

4. Risk, AML, and Compliance Intelligence

- Real-time AML/KYC monitoring and counterparty risk scoring (0–99) for exchanges, wallets, and VASPs.

- Supports institutional compliance workflows aligned with CARF, MiCA, and FSA regulatory frameworks.

- Enables automated alerts, case management, and audit-ready reports for stablecoin issuers and financial institutions.

💡Compliance teams can use Lukka’s risk and compliance intelligence to continuously monitor transactions and counterparties across global networks.

They can identify high-risk wallets, track exposure across trading venues, and generate regulator-ready reports – strengthening compliance oversight for stablecoin issuers, custodians, and fund managers.

The Broader Shift: Stablecoins, RWAs, and Institutional Trust

The launch of JPYC isn’t just a Japan story, it’s a signal of what’s coming globally.

Regulated, asset-backed stablecoins will serve as the backbone of tokenized finance, where every instrument, from corporate bonds to real estate funds – exists as programmable, transparent, and auditable tokens.

Lukka’s infrastructure ensures this next phase of adoption can operate under the same principles that define traditional finance:

- Trust: SOC 1 and SOC 2 Type II-audited infrastructure built for institutional standards.

- Truth: GAAP- and IFRS-aligned fair market value pricing.

Transparency: Full lineage and audit trails for every asset, transaction, and valuation.

Why It Matters for Financial Institutions

For banks, asset managers, and regulated issuers, the opportunity is clear:

- Accelerate innovation without compromising compliance.

- Expand market access through 24/7 tokenized liquidity.

- Reduce operational risk with unified pricing, reference data, and AML infrastructure.

Whether launching a yen-pegged stablecoin, tokenizing fixed income instruments, or pricing global real-world asset portfolios – Lukka provides the institutional rails to make it possible.

What This Means for the Future of Finance

JPYC marks a defining moment for digital assets: the era of regulated stablecoins and real-world asset tokenization is here.

Institutions need trusted data, pricing, and compliance systems to make it work.

Lukka delivers the infrastructure for that transformation, unifying on-chain innovation with off-chain trust.

Ready to build your regulated digital asset strategy? Contact Lukka to explore how our pricing, data, and compliance solutions power stablecoins and tokenized markets with institutional confidence.