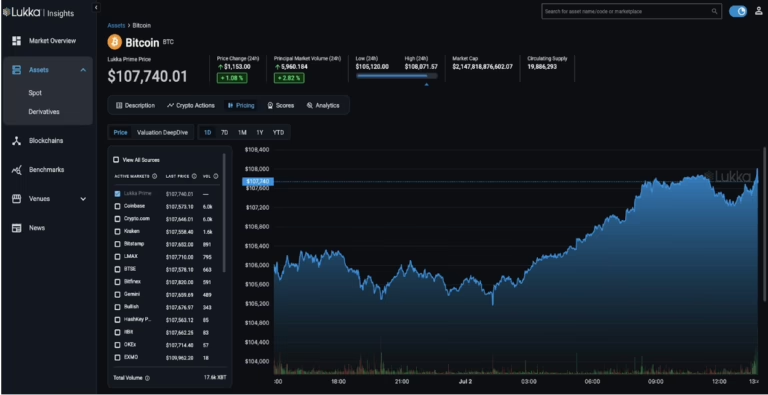

Transparent, Institutional-Grade Digital Asset Pricing

Accurately valuing digital assets remains one of the most persistent challenges in the industry. Many platforms still rely on pricing from unverified exchanges, websites, or simplistic volume-weighted averages that fail to account for data quality and appropriate financial reporting standards. The result is often inconsistent, unreliable inputs that may introduce noise into financial systems and increase the risk of errors, misstatements, and audit issues.

Lukka Prime solves this with institutional-grade Fair Market Value (FMV) pricing, purpose-built to meet the demands of US GAAP (ASC 820), IFRS 13, and other global accounting standards.

It is also the world’s first transparent crypto-to-crypto pricing methodology specifically designed to align with both US GAAP and IFRS guidance.

Lukka Prime uses a range of variables to identify the principal exchange for a given asset at regular intervals and derives pricing from that primary source, ensuring accuracy, consistency, and transparency in your valuations.

Our methodology is rigorously overseen by our Price Integrity Oversight Board. This dedicated board ensures the continuous accuracy, appropriateness, and integrity of our pricing methodologies amidst evolving market conditions and regulatory changes. They play a critical role in reviewing and validating our processes, ensuring that Lukka Prime consistently delivers the most reliable and auditable digital asset valuation.

Expanding Coverage: Now Includes Tokenized Equities

As part of its commitment to staying at the forefront of digital asset innovation, Lukka Prime now offers pricing coverage for tokenized equities. This expansion supports the growing market for Real World Assets (RWAs) and reflects Lukka’s broader mission to bring clarity and control to emerging asset classes on blockchain infrastructure.

- Fair Market Value Pricing of Tokenized Equities

Through Lukka Prime, customers can now access audit-ready pricing for tokenized equity instruments. This expansion adheres to the same rigorous standards aligned with US GAAP (ASC 820) and IFRS 13, ensuring that valuations of tokenized assets are defensible, consistent, and regulator-ready. - Reference Data Enhancements

As tokenization grows, maintaining accurate identifiers, asset classifications, and linkage to underlying securities becomes critical. Lukka’s Reference Data feeds introduced support for tokenized equities in 2021 – providing a trusted foundation for effective risk, compliance, and portfolio management:

- Legal Entity Mappings – Links tokenized assets to issuers (e.g., Apple for AAPLx) to support regulatory and audit needs.

- Spot Trading Mappings – Connects RWAs to trading pairs and venues across CEXs and DEXs for full market coverage.

- Derivative Mappings – Maps tokenized assets to related on- and off-chain derivatives for exposure and risk analysis.

- Asset Metadata – Provides token standards, contract addresses, classification data and more for operational clarity.

- Risk Scoring – Offers risk-based scores based on liquidity, integration, and ecosystem signals.

Designed for Accuracy, Built for Compliance

Lukka Prime is purpose-built for organizations that require accurate, audit-ready valuations for financial reporting and regulatory filings. As noted above, its pricing methodology is specifically aligned with established accounting principles to ensure consistency, defensibility, and transparency in financial reporting.

Key features of the Lukka Prime methodology include:

- Principal Market Identification

A structured, rules-based approach to market with the highest volume and activity for each asset, consistent with ASC 820 and the AICPA Digital Assets Practice Aid. - Unadjusted Exit Prices

Prices reflect the actual exit price from the identified principal market at the time of measurement, without the use of smoothing, averaging, or block trade adjustments. - Dynamic Market Assessment

Lukka Prime continuously reassesses the principal market in response to liquidity shifts and structural changes to ensure timely valuation sources. - FMV Alignment with Global Standards

Valuations are fully aligned with ASC 820-10-35 and IFRS 13, supporting rigorous financial reporting and audit readiness. - Transparent and Peer-Reviewed Methodology

Lukka’s valuation approach is fully documented in a public White Paper and has been peer-reviewed by auditors and leading academics, and published in a top-tier academic accounting journal, giving stakeholders confidence in its reliability and audit readiness.

Real-Time Data with Trade-Level Transparency

Lukka Prime is widely recognized by auditors and regulators globally for its reliable and accurate digital asset pricing. The platform delivers real-time valuations based on trade-level data, sourced from over 18 vetted exchanges.

Each valuation includes:

- Timestamps for precise market reference

- Trade volumes for added market context

- An exchange quality rating for data reliability

This transparent foundation ensures that every price is backed by defendable, traceable data—ideal for institutions requiring audit-ready insights.

Trusted by Institutions Worldwide

Lukka Prime is trusted by the largest global institutions such as Bloomberg and Invesco for its robust data quality, operational controls, and independent verification. It is supported by:

Certifications and independent reviews include:

- SOC 1® Type II and SOC 2® Type II compliance

- ISO/IEC 27001 certification for information security

- Review against IOSCO Principles by a Big Four accounting firm

Comprehensive Coverage and Flexible Integration

Lukka Prime offers extensive coverage and flexible delivery methods to support a wide range of use cases across accounting, finance, risk, and operations.

- 4,500+ liquid crypto assets covered

- 18 potential principal markets monitored

- 10+ years of pricing history

- Flexible delivery including REST API, WebSocket, FIX, and SFTP

This ensures that pricing data can be seamlessly integrated into real-time systems, back-office processes, or scheduled financial reporting.

Summary of Key Advantages

Feature Description

Fair Market Value Pricing | Fully aligned with GAAP and IFRS requirements |

Market-Driven Pricing | Based on actual exit prices from the most active principal markets |

Methodological Transparency | Public white paper and peer-reviewed validation |

Institutional-Grade Controls | SOC, ISO certifications, and governance board oversight |

Flexible Delivery | API, FIX, WebSocket, and SFTP integration for any system setup |

Tokenized RWA Pricing | Expanded coverage into the growing RWA space |

Learn More

If your organization requires credible, transparent, and audit-aligned pricing for digital assets, Lukka Prime provides a trusted foundation.

To explore the full methodology or request a product demo, contact us here or visit lukka.tech.