Free Institutional-grade crypto tax software built for CPAs and Tax Practitioners. LukkaTax for Professionals simplifies the complex process of collecting, standardizing, and correcting taxable crypto transaction data.

Lukka has partnered with CPA.com to provide tax professionals with the crypto ecosystem’s most trusted tax calculation platform.

Lukka Tax Solutions streamline the process, offering a comprehensive suite of tools designed to simplify crypto tax reporting. Whether you’re an individual investor, trader, or enterprise, our advanced tax solutions provide accurate calculations, gain/loss tracking, and seamless tax form generation. Navigate the complexities of crypto taxation confidently with Lukka.

Scale Your Business and Expand Crypto Proficiency

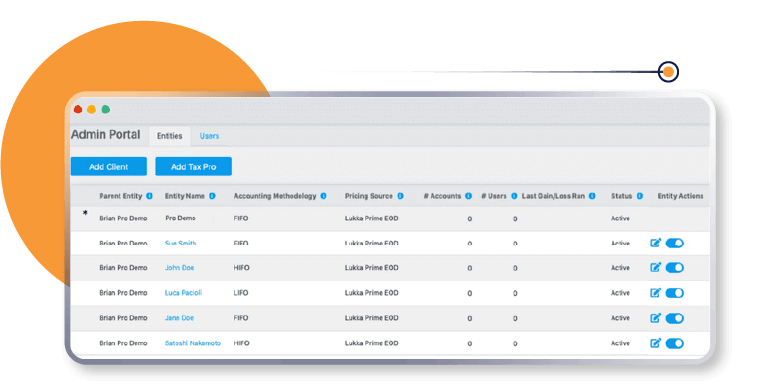

LukkaTax for Professionals scales to your practice’s needs. Our cloud software supports single-practitioner firms, all the way up to firms with hundreds of individual CPAs and tax practitioners.

Review and generate tax forms in just three simple steps, streamlining the tax preparation process.

Seamlessly adapt from single-practitioner firms to large practices. Add users and clients without additional costs, ensuring cost-effective growth.

Manage user settings and client onboarding effortlessly through a unified, user-friendly dashboard.

Effortlessly import client data from major exchanges or empower clients to do it themselves. Access 300+ APIs and pre-mapped files for comprehensive exchange coverage with a guided interface.

Speak with one of our data experts and unlock the full potential of your crypto business.

Discover how our comprehensive risk frameworks maximize data quality and reliability – visit our Trust Center for more information.

…and hundreds more businesses.

LukkaTax for Professionals is a crypto asset (a.k.a ‘virtual currency’, ‘digital asset’, or ‘cryptocurrency’) tax preparation solution, built in partnership with CPA.com and brought to you by Lukka, an AICPA SOC company.

LukkaTax for Professionals is not designed to replace your existing tax preparation software, but rather compliment it by simplifying the extremely complex process of collecting, standardizing, and correcting taxable events based off of crypto transaction data. LukkaTax for Professionals will create downloadable capital gains, ordinary income, and an unrealized holdings reports (with detailed tax lot IDs for each asset) for you to use when preparing 1040 Schedule 1, and 8949 tax return forms in the software that you are used to and familiar with.

LukkaTax for Professionals is free to use; pricing is not impacted by the number of respective client transactions.

Contact us for more information.

Yes, LukkaTax for Professionals has user management and client management dashboards to manage all your professionals and clients through your single user name and password. Adding additional professionals to your account is free. Adding additional users to your account is also free.

We use 50+ reconciliation reports and features to ensure your data is complete.

Yes, if applicable for your client, LukkaTax provides detailed reports (with specific and discrete tax IDs, ordinary income reports, and unrealized holdings reports in CSV format) for you to download and then use when preparing the rest of your clients’ returns.

If needed in the future, you can always access these reports from the site using your login credentials. Have a specific format that your firm requires? We can create custom formatted reports for you.

Yes, LukkaTax for Professionals supports all of these types of situations.

LukkaTax for Professionals allows you to categorize any transfer as income (based on FMV at that date/time) if applicable and then provides a detailed income report for you to download. Additionally, acquisitions will be created for all capital assets and cost basis will be recorded at FMV.

LukkaTax will also allow you to add notes, delete transactions, and compare gain/loss results based on various accounting methods (FIFO, LIFO, and Optimized).