Lukka’s institutional-quality data management software is built within an AICPA SOC 1 Type II and SOC 2 Type II infrastructure and provides a comprehensive, secure, and scalable technology for your crypto middle and back-office.

Home › Quantitative Risk & Analytics Data

Elevate your investment strategy and risk management with Lukka’s sophisticated analytics tools — Discover the edge you need in the dynamic world of digital assets today!

…and hundreds more businesses.

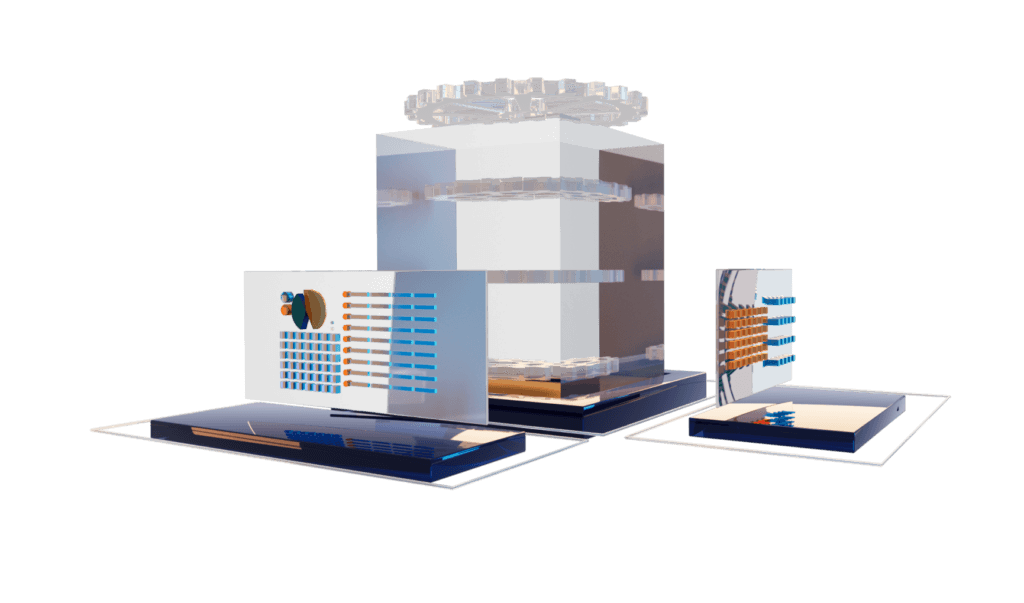

Harness the power of advanced analytics with Lukka’s Quantitative Risk & Analytics Data. Delve into the heart of market volatility with our Implied Volatility Surfaces, offering essential insights through the lens of the options market. Understand the intricacies of interest rates with our Implied Interest Rates, capturing the derivatives market’s perspective. Plus, expedite your asset comparison process using the Lukka Related Asset Recommendation Engine, efficiently finding comparable digital assets in mere seconds.

Gain insight into the market’s view of volatility as viewed through the lens of the options market.

Gain insight into the market’s view of interest rates as viewed through the lens of the derivatives market.

Find comparable digital assets in seconds, not hours…days…or even weeks!

Speak with one of our data experts and unlock the full potential of your crypto business.