Introduction to Quantitative Risk Assessment

Quantitative Risk Assessment (QRA) is a fundamental methodology in financial risk management, utilizing statistical models and data-driven analysis to evaluate exposure to financial, operational, and market risks. In traditional finance, QRA has been extensively used to assess credit risk, counterparty risk, and asset price volatility, among other metrics. However, the complexities of digital assets introduce new dimensions of risk that demand a more evolved approach.

Unlike traditional assets, crypto assets operate in a decentralized, often pseudonymous environment with unique liquidity patterns, 24/7 trading cycles, and the absence of central clearinghouses. Risks in this space extend beyond price volatility to include counterparty exposure, cybersecurity vulnerabilities, regulatory uncertainties, and systemic blockchain disruptions. As financial institutions, regulators, and businesses accelerate digital asset adoption, the need for a structured, data-driven risk assessment framework has never been greater.

Lukka provides a comprehensive suite of solutions designed to enhance QRA in the crypto ecosystem, equipping institutions with real-time data, advanced analytics, and automated compliance monitoring. By leveraging Lukka’s industry-leading tools, organizations can proactively measure, track, and mitigate digital asset risks – ensuring financial stability, regulatory alignment, and operational resilience in an evolving market.

Quantitative Risk Assessment in Digital Assets

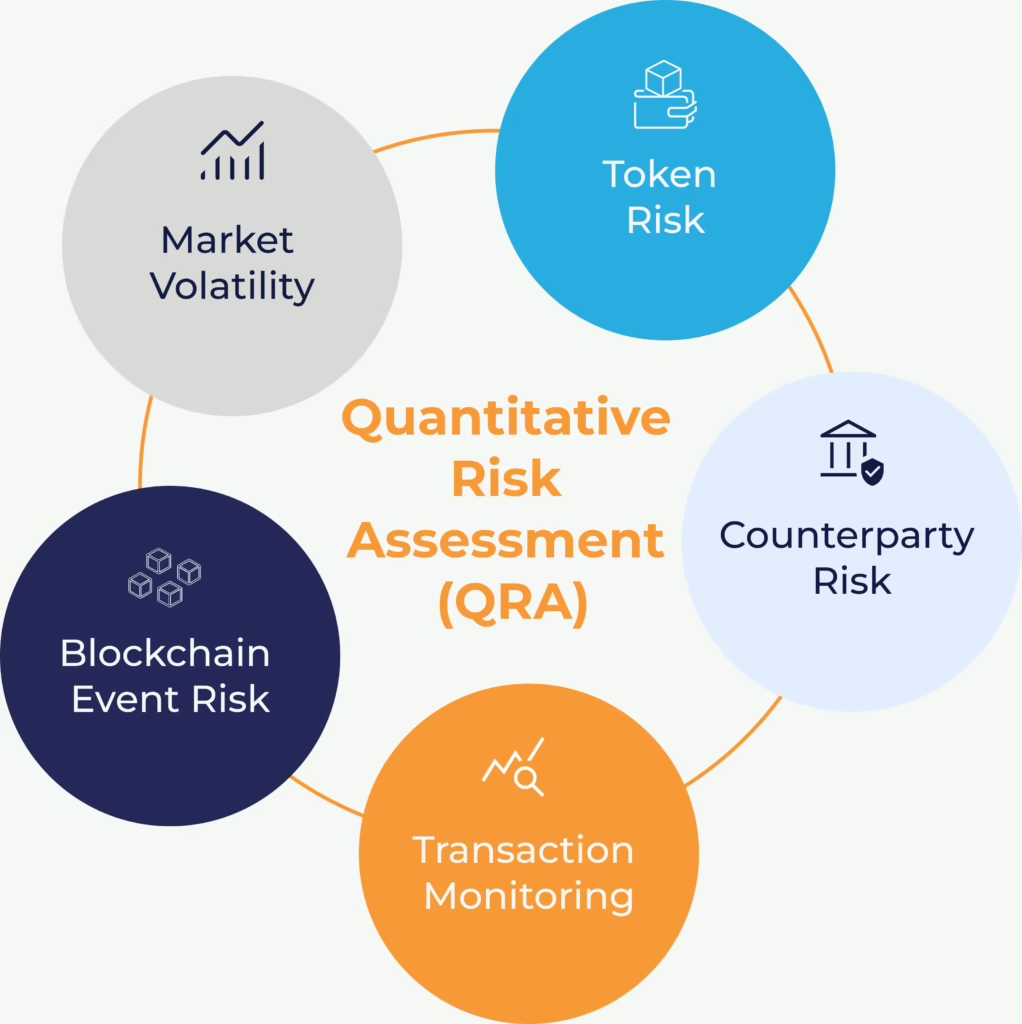

Applying Quantitative Risk Assessment (QRA) to digital assets requires a broader perspective beyond traditional financial risk models. Risks in this sector are often influenced by factors such as smart contract vulnerabilities, protocol governance structures, on-chain liquidity, and counterparty stability – elements largely absent in more traditional markets. To conduct effective risk assessments, organizations must address these unique challenges that are uniquely inherent to the crypto ecosystem.

One of the most pressing challenges is the lack of standardized valuation methodologies. Unlike equities, where fair value can be derived from financial statements and earnings projections, digital assets lack universally accepted valuation principles. This absence introduces volatility risk and complicates portfolio risk assessments. Our Lukka Prime pricing methodology addresses this challenge by providing a fair market value pricing model, offering institutions accurate and reliable asset valuation in an industry where markets never close. By also being aligned with GAAP and IFRS accounting principles, CFOs and other Finance executives know that their financial reports are increasingly audit-ready.

Counterparty risk is another major concern. In traditional finance, institutions operate under stringent regulatory oversight, but in the digital asset space, service providers span multiple jurisdictions with varying compliance standards. Exchanges, custodians, and trading firms implement different risk management frameworks, the resulting uneven playing field leading to potential vulnerabilities in counterparty interactions. Lukka Marketplace & Custodian Data provides a comprehensive risk evaluation framework, assessing operational integrity, licensing status, and historical performance of market participants to help institutions identify and mitigate counterparty exposure.

Additionally, blockchain-specific risks – including protocol failures, hard forks, and airdrops – must be factored into QRA models. The digital asset ecosystem can be disrupted by unexpected changes at the protocol level, affecting asset prices and liquidity. Lukka Crypto Actions Data enables organizations to monitor and respond to blockchain events in real time, allowing institutions to seamlessly integrate these risks into their assessment frameworks.

A robust approach to digital asset risk management requires a combination of on-chain and off-chain data analytics, automated compliance tools, and a structured methodology for evaluating financial exposure. With Lukka Blockchain Analytics, institutions gain access to real-time transaction monitoring, AML risk scoring, and wallet tracking capabilities, ensuring a comprehensive, proactive approach to risk mitigation in the evolving crypto landscape.

Assessing Token and Market Risks

Digital asset markets are inherently volatile, driven by fragmented liquidity, rapid market cycles and speculative trading. Unlike more traditional securities, cryptocurrencies often lack robust price discovery mechanisms, making it challenging for institutions to accurately assess investment risks. To understand exposure to highly volatile or illiquid tokens, institutions must evaluate an asset’s liquidity, trading history, and governance structure before making investment decisions.

Lukka Crypto Asset Score provides a comprehensive risk framework that evaluates over 30 key factors, such as token liquidity, market reputation, governance models, and technical security. By leveraging these insights, institutions can make informed decisions regarding asset suitability for investment, trading, or custody. Lukka’s Coin Asset Score helps formulate a structured Quantitative Risk Assessment (QRA) approach that must incorporate the necessary fundamental analysis, technical evaluation, and on-chain data insights to determine the financial stability of the digital assets in scope.

Another critical challenge is price transparency. Digital assets trade across multiple exchanges, each with varying liquidity levels and price discrepancies, leading to unreliable market valuations. Lukka Prime addresses this issue by delivering standardized fair market value pricing, ensuring institutions have a clear, accurate benchmark for risk modeling and financial compliance.

By integrating structured risk assessment methodologies and trusted pricing solutions, institutions can navigate the complexities of digital asset markets with greater confidence, mitigating risks associated with volatility, liquidity fragmentation, and valuation inconsistencies.

Counterparty and Transaction Risk Considerations

In traditional finance, counterparty risk assessments rely on credit ratings, financial disclosures, and regulatory compliance records. However, the digital asset ecosystem operates in a world of limited transparency, making counterparty evaluation significantly more complex. The decentralized nature of many trading platforms exacerbates this challenge, as institutions frequently engage with counterparties without clear indicators of financial solvency indicators or operational stability.

To navigate this uncertainty, financial institutions need more than just conventional risk assessment tools – they require comprehensive, real-time intelligence solutions. This is where Lukka stands apart. Lukka Marketplace & Custodian Data provides institutions with a structured framework to assess counterparty risks across exchanges, custodians, and liquidity providers. Our platform delivers in-depth insights into operational integrity, historical compliance records, and liquidity stability, enabling institutions to make data-driven decisions when selecting trading partners. With Lukka, institutions can mitigate risks by ensuring that every counterparty they engage with is thoroughly vetted.

However, counterparty risk is just the beginning. Digital asset markets introduce transaction-level risks that need careful monitoring and scrutiny. Blockchain transactions are irreversible, making the detection of illicit financial activities like fraud, money laundering, and darknet transactions far more challenging. Lukka Blockchain Analytics offers a cutting-edge solution, providing real-time transaction monitoring, risk scoring, and wallet activity tracking. With these tools, institutions can identify and prevent involvement in illicit transactions, protecting both their reputation and bottom line.

As the regulatory landscape for digital assets continues to evolve, staying ahead of compliance requirements is critical. With an increasing global focus on digital asset markets, institutions must ensure they meet anti-money laundering (AML) and counter-terrorism financing (CTF) standards. Lukka Blockchain Analytics provides sanction screening and risk modeling tools, enabling financial institutions to proactively monitor blockchain transactions for suspicious activity, ensuring adherence to regulatory requirements, and facilitating seamless compliance reporting.

The Future of QRA in Digital Assets

The evolution of Quantitative Risk Assessment (QRA) in the digital asset ecosystem is being driven by the growing need for institutional-grade risk management tools that address the complexities of blockchain finance. As this dynamic market matures, traditional risk frameworks must adapt, integrating on-chain analytics, predictive modeling, and regulatory intelligence to provide a comprehensive, forward-looking risk assessment approach.

Institutions that implement comprehensive QRA strategies will be better positioned to manage digital asset portfolios, mitigate market volatility, stay ahead of evolving regulatory landscapes. By leveraging the data-driven solutions below, businesses can significantly enhance risk visibility, optimize decision-making, and strengthen operational resilience.

As digital assets increasingly move closer with traditional financial markets, the ability to implement a robust and adaptable risk assessment methodology will be a key differentiator for institutional players. Organizations that proactively develop and refine their QRA frameworks today will be well-positioned to lead the industry, ensuring stability, regulatory compliance, and long-term growth in the rapidly evolving digital asset landscape.

In this era of digital transformation, Lukka stands at the forefront, offering innovative tools and comprehensive solutions to empower institutions in their risk management strategies.