Blockchain Analytics for transaction, wallet and cluster monitoring for crypto assets.

Lukka Blockchain Analytics is a web-based Software as a Service (SaaS) product that analyzes your business’s on-chain data in order to support:

1.8 Million+

Crypto Assets

an industry leading 98% of the market

50,000+

Blockchain entities actively monitored

100+

Blockchain Protocols

Utilize comprehensive features to support your on-chain analytics, monitoring risk reporting and case management, and more.

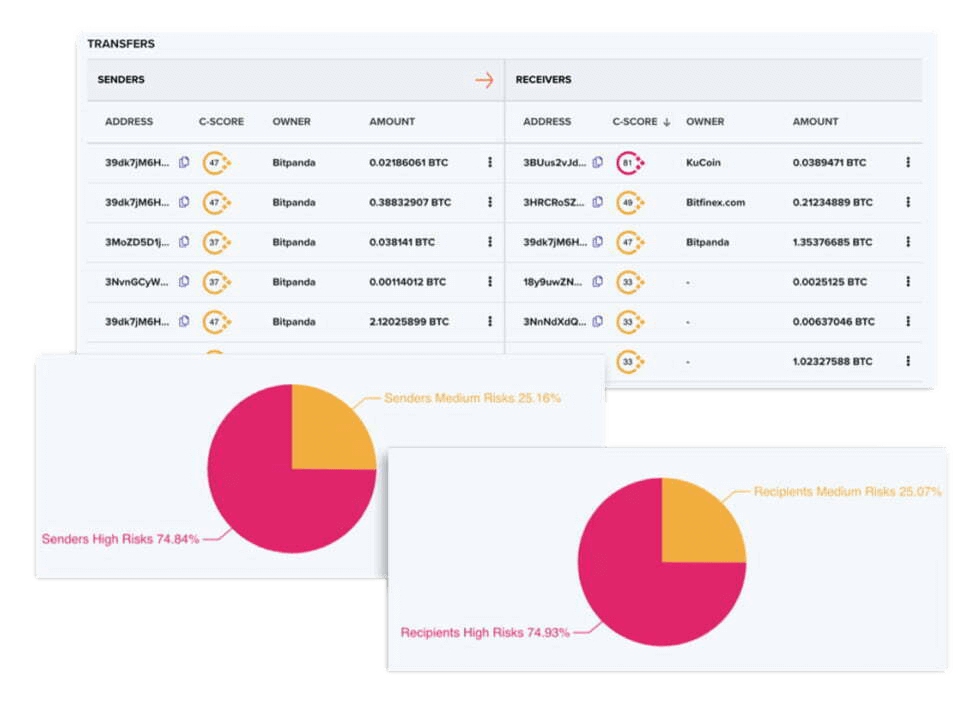

Analyze your digital asset wallets and transactions to identify unknown counterparties and transactional patterns.

Get real-time alerts and risk reports for thousands of wallets based on behavioral changes and entity classifications. Now includes detection for MiCA-licensed entities, crypto brokers, and Forex traders—enabling even more granular AML risk monitoring.

Assess address and entity exposure to a range of risks including sanctions, money laundering, terrorism financing, and regulatory licensing. Identify MiCA-licensed participants with new regulatory flagging features.

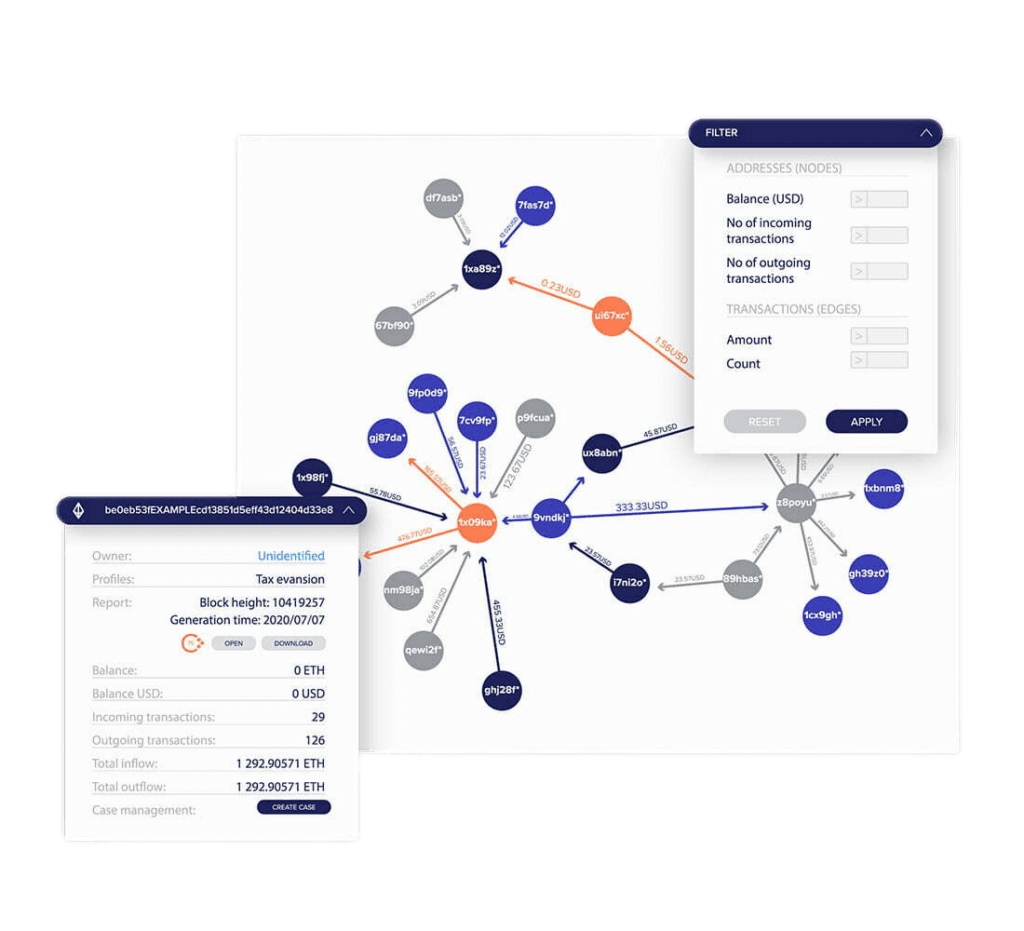

Unveils comprehensive transaction analysis by allowing users to trace the journey of funds through detailed reports on any blockchain address or transaction list.

100+ Blockchain Protocols

Among them:

Speak with one of our data experts and unlock the full potential of your crypto business.

Investigate the transaction history of any supported blockchain address. Simply enter the address, transactions or entity to unveil its connections, transactions, risk exposure and more. Observe the aggregated flow of funds or dig deeper to pinpoint specific transfers, connecting real-world entities to the blockchain ecosystem.

Blockchain Analytics in Omni provides detailed transaction analysis across supported blockchains. Track the source and destination of funds, identify risk exposure, and connect blockchain activity to real-world entities—all powered by the industry's most comprehensive on-chain and off-chain dataset.

Get detailed information about legal entities operating in the blockchain ecosystem, predominantly virtual asset service providers (VASPs) such as cryptocurrency exchanges.

AML Risk Reports for Full Compliance

Investigate and assess address risk exposure to various risks such as sanctions, money laundering, or terrorism financing in seconds using Lukka’s market-leading risk assessment model.

Liquidity Pool Risk Reports

Comprehensive risk management solution that can analyse any DeFi liquidity pool for a swift, scalable solution. Understand where serious compliance and risk red flags are. For any given liquidity pool - the exposure of high-risk addresses contributing to the pool is analysed with direct and proximity-related risks identified.

The blacklisting tool on Lukka Blockchain Analytics (SaaS) allows users to cross-check addresses against OFAC, HMT and the EU’s sanctions lists to verify whether they belong to or are related to sanctioned subjects. 100,000+ addresses are identified as being linked to sanctions.

…and hundreds more businesses.

The term crypto assets refer to a broad new class of assets created through Distributed Ledger Technology (DLT). DLT allows data to be stored in multiple decentralized locations on a common network, enabling participants to track ownership and transfer of virtual assets, such as crypto assets. Virtual assets have unique characteristics, positive and negative, compared to traditional assets and payments. However, questions often arise among those interested in crypto assets regarding transactions – how to track crypto transactions, how to report crypto transactions, or how to trace a crypto transaction. We will clarify these questions and show how to keep track of crypto transactions.

Crypto transactions are a confirmed transfer of digital money issued to the network and then stored in the form of blocks. Any user can follow the chain of operations, even from the beginning, i.e., receipt of the first crypto assets. Crypto transactions are carried out between unique wallets. Usually, users buy crypto to make money from exchange rate fluctuations. In addition, they can also use crypto assets to pay for various goods and services online.

When initiating crypto transactions, it is essential to know that no actual transfer of the fiat form of money occurs in the process. Instead, only a typed number of coins are transferred (from one wallet to another), and the transaction information is publicly available in encrypted form.

For this reason, the questions that often arise about how to track crypto transactions, how to see crypto transactions, or how to trace a crypto transaction should be focused on finding the right software to accomplish such tasks. This is because it will make it possible to efficiently manage your portfolio and reap the maximum benefits from crypto investments.

There are different ways to track crypto transactions. Among these, the key ones are:

If you are wondering how to track a crypto transaction, you can use a blockchain explorer. Those systems are dedicated to monitoring transactions in specific blockchains. How do they work? Enter a wallet’s public address or transaction identifier (TXID) into the search field to see transaction details such as amount, time, sender and recipient addresses, and confirmations.

If you use a crypto wallet app like Exodus, Ledger Live, or Trust Wallet, you can track your transactions right there. In the majority of cases, they let you simply track your financial transactions and view the whole history inside the app.

Technological innovations, including crypto transaction tracking software, also help answer the question of how to trace a crypto transaction. Thanks to them, it is possible to track assets in real-time, which translates into greater profits from crypto assets as well as an increased level of security.

Options to set up email or SMS notifications of completed transactions are available on several crypto exchanges and wallets. You can configure these alerts to get real-time data regarding transactions.

It is essential to be careful and maintain the privacy of your data when tracking crypto transactions. Ensure you use trusted sources and do not share your private keys or other sensitive information with unauthorized parties.

The answer to this question may seem straightforward at first glance – yes, crypto transactions are traceable.

However, here comes the twist – the anonymity of crypto transactions is not as simple as it seems. While the wallet addresses used in transactions are often pseudonymous, concealing the real-world identities of their owners, the flow of funds can still be analyzed to potentially link transactions to specific individuals or organizations. This is where the puzzle of traceability gets more perplexing.

So if future dilemmas arise again, are crypto transactions traceable, it is crucial to be aware of your privacy and manage your digital currency transactions carefully.

Due to the high levels of security offered by blockchain technology, crypto transactions are typically regarded as secure. These include functioning in a decentralized environment, encrypting data with the use of sophisticated cryptographic algorithms, or verifying data via a node-based network of computers.

However, it is worth remembering that the security of crypto transactions can be compromised by inadequate management of private keys, carelessness in the use of crypto wallets, hacking attacks, forgery, or other types of fraud. Therefore, taking appropriate precautions, such as using secure wallets, storing private keys offline, avoiding suspicious websites, and avoiding sharing your confidential information, is crucial. If unauthorized asset flows are detected, on the other hand, it is worth knowing how to report crypto transactions to take timely preventive action.

If you are wondering how to track crypto transactions, it is essential to understand that most crypto assets are built on a decentralized blockchain network that provides transparent and traceable transaction data. If you additively want to know how to see crypto transactions, one way to do so is by using a blockchain explorer, a tool that allows you to search and view details of individual transactions.

Conversely, if you are troubled by how to report crypto transactions or suspect any fraudulent or suspicious activity, you may need to report crypto transactions to the relevant authorities, such as law enforcement or financial regulators, who can investigate and take appropriate action. It is crucial in this context to follow local laws and procedures for accurate reporting of crypto transactions.

Indeed, there is now growing pressure from governments and regulators to identify and monitor suspicious crypto transactions to combat financial crime, such as money laundering or terrorist financing.

Crypto assets such as Bitcoin, Ethereum, and Litecoin are gaining popularity as alternative forms of investment and means of payment. The start of 2023 for the crypto market has proven to be much better than initially thought, with the major assets significantly rebounding from the low price of late 2022. So is it worth investing funds in crypto assets? To decide, it is helpful to know what is a crypto transaction and how crypto transactions work.

Crypto assets are digital tokens, so-called virtual currencies, i.e., currencies that do not have a physical form, that allow payments to be made directly between people using online systems. Their value depends solely on people’s willingness to pay for them in the market.

crypto assets function in a distributed ledger system, which stores information about a specific wallet’s holdings in pre-approved crypto units. Each crypto unit has a unique code – this is where the data is contained to prevent it from being copied and re-spent. In addition, crypto transactions are encrypted and authenticated, making them secure and relatively challenging to defraud.

Many crypto assets are on the market, the most well-known being Bitcoin, Ethereum, and Litecoin. Each of these currencies has its unique features and benefits for users. They represent a modern form of payment that offers many advantages but requires a cautious approach. Their value depends entirely on market supply and demand, meaning investing in them can be riskier than traditional investment forms.

Crypto asset transactions work by transferring digital assets between participants in a blockchain network.

They can be conducted in 5 key steps:

Then, to make the transaction, the sender enters the recipient’s information, such as their crypto wallet address and the number of funds being transferred.

If you wonder are crypto transactions traceable or anonymous, then you should know that they are traceable and not completely anonymous. For most crypto assets, such as Bitcoin, Ethereum, and Litecoin, transactions are recorded on a public registry known as the blockchain, which allows the identification of the crypto addresses involved in the trades.

However, it is essential to know that the identity of the owner of a crypto address is not public and is not directly linked to the transaction in question. crypto addresses are usually pseudonymous and unrelated to a person’s real name. Instead, these addresses are strings of characters that can be tracked within a transaction on the blockchain.

Beyond this, crypto assets are traded electronically – peer-to-peer, without any banking system, directly between users of a particular crypto. Thanks to the encryption keys, only the parties can see the transaction, although the accounting record itself is publicly available to any participant in the network. Adequate security is also provided by crypto transaction tracking and dedicated software.

To keep crypto transactions safe, it is worth implementing a few precautions. Among the most important of these are the following:

Of particular interest should be those that have a good reputation and are recognized among the crypto community. Carefully review the regulations and security features the exchange offers before trading.

Please, pay special attention to creating unique and strong passwords for your accounts on exchanges and crypto wallets. They should contain various characters – letters, numbers, and special symbols.

Enabling an additional layer of protection by activating two-factor verification (2FA) on your accounts on crypto exchanges and wallets is also a must. This form of authentication will enhance secure access to your accounts.

Avoid clicking on suspicious links in emails, forums, or other websites. This could be a phishing attempt, i.e., to get your personal information.

Choose appropriate storage methods for your crypto assets, such as hardware wallets or paper wallets. Avoid storing large amounts of crypto assets on exchanges, as these are more vulnerable to attacks.

Ensure you use the latest versions of your crypto wallet software and other crypto-related tools. Updates often include security patches.

Regularly review information about crypto threats and take appropriate precautions. Crypto transaction tracking will help with this.

Do not share your private crypto wallet keys with outsiders. Remember that this is the key to your funds, so keep it confidential.

As crypto transactions increasingly continue its global expansion, so too grows the need to ensure that funds in circulation doesn’t have connections to any illicit activity. Regulation has been issued at staggering levels around the globe as a result, most of which require organizations such as crypto exchanges, regulators and other industry bodies to monitor crypto transactions in accordance with stringent

AML (Anti-Money Laundering) standards. To do this efficiently while also staying up-to-date on best practices however is something easier said than done – hence why it’s important to know what transaction monitoring actually is, how it works and why it’s essential for everyone involved in the crypto industry space.

Transactions are like a complex jigsaw puzzle: it’s hard to tell what the completed picture looks like based on the individual pieces. That’s why transaction monitoring is such a critical piece of any strong Anti-Money Laundering compliance program– it’s necessary to get an accurate view of transactions that involve suspicious activity. crypto stands out in this regard, as its decentralized and pseudo-anonymous nature makes it even more difficult to track these transactions. Thankfully, Lukka offers specialized tools that can help you ensure your AML guidelines are met through automated crypto transaction monitoring. So if you’re trying to tackle the formidable jigsaw puzzle that is crypto transaction monitoring, consider Lukka and their top-notch AML compliance suite.

crypto transaction monitoring has become increasingly important in recent years as more people move to digital currencies for transactional purposes. Opting for an experienced, dependable provider like Lukka Blockchain Analytics can ensure transactions are evaluated properly and features like identity checks, risk scoring, and analysis tools are employed to protect both individuals and businesses. This provides greater transparency, allowing users to understand who they’re doing business with, their transaction history or associated risks. In addition to ensuring proper compliance requirements are met within the realms of fraud prevention, anti-money laundering (AML), and Know Your Customer (KYC) regulations, transaction monitoring also offers increased convenience with automated solutions and enhanced security by enabling suspicious activity to be quickly flagged and reviewed.

Working with crypto assets was never easy. With technology making leaps and bounds in its capabilities every day, transfer monitoring has also seemingly become easier. Before, manually checking each transaction was the only way to make sure they were secure – now automated tools provide peace of mind. Lukka provides state-of-the-art tracking solutions that enable you to keep an eye on your crypto flows without having to be glued to your computer 24/7. Transaction monitoring used to be tons of work and somehow a digital rabbit hole; now it’s as simple as following digital breadcrumbs.

Tracking the movement of funds can be quite a challenge for users working with AML transaction monitoring. You never know who is behind the string of random characters you know as an address and where their funds come from. Without proper controls, it is easy to let bad actors into your business and expose to the risk of unknowingly helping to launder funds originating from a suspicious source. In such cases, the use of a suite of transaction monitoring tools is essential to minimize that risk. Lukka offers range of such services that allow clients to stay ahead of the game in terms of compliance and risk management. By discovering this level of crypto security, users and businesses can eliminate stress and keep their digital assets safe in a world filled with financial instability.

The crypto market has grown exponentially and with that massive growth comes a need for a solution to monitor and track transactions. Lukka provides tools specifically designed to help track down fraudulent or suspicious transfers—making them one of the go-to providers in the industry. Several firms have adopted our services with great success, and now have the proper tools to check if the funds flowing to their companies aren’t tainted with signs of any suspicious activity.

Global financial institutions have also started using these cutting-edge tools to gain insights into transaction behavior and detect anomalies that could potentially be linked to money laundering. Needless to say, Lukka Blockchain Analytics is revolutionizing the way people track crypto transactions, allowing more organizations to take advantage of these innovative technologies.

Transaction monitoring is a crucial part of AML compliance and helps protect institutions from financial crime. Technology has made it much easier to monitor transactions, enabling faster and more accurate detection of suspicious activity. It is important to consider the risks that come with not utilizing proper transaction monitoring solutions– from increased compliance costs to potential reputational damage.

Lukka provides powerful risk management tools for crypto transactions, making it easier for companies to stay compliant. Through its successful implementations, our effective system for crypto transaction monitoring can be invaluable in helping organizations meet their AML obligations efficiently and effectively

Money laundering involves handling money obtained through crime and severely threatens society. The illegal practice allows criminals to continue funding their activities. One of the people associated with AML is the AML analyst – the person responsible for monitoring the processes involved in handling funds. How do you get started with AML compliance? How to get into AML compliance? How to become AML analyst? You will read about it in the article.

If you’re wondering what is AML, here’s a hint – AML is an abbreviation derived from Anti-Money Laundering, a term used to describe all financial organizations’ measures to eliminate money laundering. Anti-Money Laundering (AML) programs are required of obligated institutions by governments worldwide as part of the fight against financial crimes. Comprehensive procedures involve analyzing transactions and detecting those that may be money laundering related.

Before explaining how to get into AML compliance, we briefly discuss the main tasks of a person employed as an analyst.

The AML analyst also must cooperate with regulators. This includes sharing data and collaborating with investigations related to money laundering.

The responsibilities of an AML analyst may vary depending on the financial institution where they are employed, as well as local regulatory requirements in the country. So how to get into AML compliance and how to become AML analyst? About this in the next paragraph.

Getting a directional education to start a career as an anti-money laundering (AML) analyst would be best. To work in this industry, it is recommended to have a degree related to finance, economics, law, or other related fields. Practical skills in analyzing financial data, detecting suspicious patterns, and tracking money flow are also essential for the AML analyst position.

How to become an AML analyst? To improve your skills, taking part in training courses is advisable, allowing you to obtain AML-related certifications. As a confirmation of knowledge and skills in anti-money laundering, it can help gain attractive employment. It is also necessary to keep up to date with changing AML-related regulations and tools for detecting irregularities like Lukka Blockchain Analytics or AML Oracle.

You already know how to become AML analyst. Whom is the job helping with anti-money laundering? An AML analyst at an obligated institution must understand the financial market and its regulations, as well as be familiar with risk management methods. Among the competencies valued by AML analysts are, first of all, highly developed analytical thinking and risk assessment skills. An employee employed in this position should also be characterized by excellent perceptiveness, meticulousness, and the ability to cooperate. Applicable regulations should carry out the tasks included in the scope of his duties.

Money laundering is seen as one of the critical risks in the crypto market. By design, anonymous and difficult-to-track crypto market transactions encourage financial crimes and can be used to launder illegally earned income. In the article below, we discuss crypto money laundering statistics. How are cryptos used in financial crimes? How can they be prevented?

Before we look at the crypto money laundering statistics, let’s explain what this illegal practice actually consists of. According to the accepted definition, it is a process in which the origin of illegal funds is concealed by introducing them into legitimate economic circulation. Money laundering became a common way to avoid responsibility for illegal transactions in the 1980s, with the rise of organized crime. For example, money laundering allows drug traffickers, tax evaders, human traffickers, or terrorist organizations to hide their income and remove themselves from legal responsibility.

With the emergence of Bitcoin, crypto assets have been seen as a potential tool for fraud. Skeptics point out that in the hands of cybercriminals, digital assets are an easy way to launder funds. To some extent, anonymous, easy to transfer, and with a global reach – crypto assets, due to their characteristics, can be used to put illicit money into circulation. In this regard, several crypto money laundering techniques can be distinguished.

Statistics show that the most common way to hide illegal funds is using so-called mixers, by which transactions on the blockchain are mixed. As a result, tracking them and thus detecting irregularities is much more difficult. The scale of crime in the crypto world is increasing year on year. In 2022, the value of crypto-assets stolen through various crimes increased by 51% over the previous year, reaching a value of more than $3.5B. Let’s look at a few events from this period for a better understanding of the scale of this problem.

August 2022: Nomad Bridge- a decentralized protocol that enables users to transfer their crypto assets between different blockchains, including Avalanche (AVAX), Ethereum (ETH), Evmos (EVMOS), and Moonbeam (GLMR). An attacker and copycats were able to exploit a bug in the Nomad bridge contract and withdraw over $190 million worth of crypto from the platform.

Not since today have crypto assets stirred up considerable controversy. Illegal activities are facilitated by the digital form and decentralized nature of crypto assets, which can contribute to their use by criminals.

Detailed crypt money laundering statistics are difficult to provide – many procedures have not been detected. At the same time, it should be emphasized that it is still cash, not crypto assets, that is the primary tool used to purify dirty money.

Crypto money laundering statistics reflect negatively on their perception and further adoption. Governments around the world are focusing on combating crypto money laundering. Increasing attention is being paid to tracking the flow of funds and identifying suspicious transactions. In addition, data analytics tools are helping to identify behavior indicative of money laundering. As a result, crypto money laundering statistics can be expected to decline in the coming years.

The risks associated with the possibility of money laundering via crypto assets are one of the arguments for comprehensive regulation. The proliferation of AML regulations implemented by more countries, as well as the obligation to conduct KYC, contribute to blocking potential money laundering attempts. With the regulation of the crypto market, it can be expected that the fight against money laundering in this rapidly growing sector will become more and more effective.

Illegal activities can also be prevented through close cooperation between market players, especially regulators and crypto exchanges, and with the help of improvements such as AML platform. In doing so, it is necessary to exchange information between them, allowing for easier detection of financial crimes linked to crypto assets. Undoubtedly, an effective fight against money laundering through crypto assets will play a vital role in the sector’s further development.

The development of new technologies and the significant adaptation of the digital world encourage the emergence of previously unknown forms of crime – including in the crypto market. In addition, the tightening of AML regulations is causing criminals to explore new areas that are not yet adequately regulated and secured to achieve their goals. If you are an active participant in the crypto market, then be sure to read this article. From it, you will learn what crypto AML red flags are, AML red flags indicators, and how to avoid fraud.

AML, or Anti-Money Laundering, is a procedure to prevent money laundering. Under the AML procedure, financial institutions or other entities in contact with settlements must detect and prevent illegal payment transactions. These measures may include verifying the identity of customers, monitoring transactions, and reporting suspicious activity to the relevant law enforcement authorities. In addition, financial institutions are required to apply internal procedures and employee training on anti-money laundering.

AML (Anti-Money Laundering) red flags are indicators or warning signs suggesting potential money laundering or terrorist financing activities. They are used by financial institutions, such as banks and other money markets or insurance-related entities, to identify suspicious transactions or actions that may violate laws and regulations against illegal financial transactions.

Common examples of AML red flags include:

It should be noted that one or more red flags in transaction monitoring do not necessarily mean that money laundering or terrorist financing is taking place. These situations can also be linked to cyber-attacks or some other form of phishing attempt. Whatever their nature, however, they may warrant further investigation and report to the relevant authorities as part of the financial institution’s AML compliance obligations.

Crypto AML red flags are also indicators that provide information about potentially suspicious crypto activities. In addition, these crypto red flags serve as warning signs indicating criminal activity, including money laundering or other illegal activities.

Digital currency exchanges and other virtual asset service providers (VASPs) can gather crucial data and gain insight into potential risks and vulnerabilities in their systems by discovering and analyzing crypto AML red flags. This way, crypto red flags can provide valuable information and help to detect potentially suspicious activity and indicate where action needs to be taken, such as conducting further investigation, reporting to the relevant authorities, or implementing enhanced due diligence measures.

By understanding the importance of transaction monitoring red flags and AML red flags indicators and how they may be linked to money laundering or other illegal activities, the crypto market can dramatically strengthen its AML compliance efforts and reduce the risk of being used as a conduit for illegal activities involving crypto assets.

Although the crypto market shows a high level of transaction security thanks to blockchain technology, with the growing popularity of this sector, more and more cases of illegal activities are emerging. To avoid these, it is worth opting for crypto AML software, which ensures compliance with regulations and, at the same time, counteracts money laundering. With its help, you can gain an in-depth understanding of the market situation in just a few seconds with risk checks and data points, ranging from financial crime to counterparty identity.

In addition, transactions and addresses recorded on a blockchain with multiple inputs and outputs can be easily monitored, significantly increasing security. Just as importantly, this type of software sends alerts on high-risk crypto wallets and provides the ability to monitor transactions in real-time to perform efficient due diligence checks for compliance.

The landscape of global finance has undergone a profound transformation owing to the surging popularity of crypto assets. Yet, amidst the widespread interest in the crypto market and its associated blockchain technologies, concerns loom large when it comes to the security of digital assets. A pressing question emerges: Do crypto assets necessitate regulation? What are the benefits of regulating crypto? Why crypto regulation is important? In the following article, we discuss the benefits of regulating crypto assets, which may determine the further sustainable development of the sector.

The main concern is the security of crypto assets. Associated with them is the risk of fraudulent practices, resulting in the loss of funds. In addition, crypto transactions – which are mainly anonymous – are also susceptible to illegal activities, most notably money laundering, terrorist financing, or drug trafficking.

Why crypto regulation is important? Answering the question of why it is essential to regulate crypto assets, one should point to the growth of interest in crypto assets, on the one hand, and the growing risk of financial fraud and criminal activities, on the other.

Today, more and more countries recognize the need to exercise control over crypto – the sector is regulated in countries such as the United States, Canada, the United Kingdom, Japan, South Korea, and Germany, among others. You can read more about this in an article on crypto regulations around the world.

The regulation of crypto assets varies from country to country. Some of them have introduced mechanisms such as registration of crypto exchanges, KYC (Know Your Customer) procedure, infrastructure security requirement, and rules on anti-money laundering (AML) and counter-terrorist financing (CTF).

The interests of investors and the sector’s security are also positively affected by defining the rules of crypto-related companies. Top-down guidelines (e.g., licensing of companies, financial reporting, or identifying customers) ensure better transparency and greater accountability to market participants.

The increasing popularity of crypto assets, such as Bitcoin, has led to a heightened focus on the importance of regulations and compliance. One such regulation that has become crucial for the crypto industry is Know Your Customer (KYC). KYC in crypto has emerged as a critical process that helps to combat illegal activities like money laundering and terrorist financing. In this article, we will explore what does KYC mean in crypto, the significance of KYC in crypto, KYC in Bitcoin, the role of Lukka Blockchain Analytics platform, and the impact of the Travel Rule on crypto transactions.

KYC, or Know Your Customer, is a set of procedures used by financial institutions and businesses to verify the identity of their customers. In the context of crypto assets, KYC in crypto requires users to provide their personal information, including name, date of birth, address, and a valid identification number, such as a Social Security number, passport number, or driver’s license number. Customers may also need to submit proof of identification and proof of address documents.

Implementing KYC in crypto is vital to ensuring that digital currencies and the platforms that facilitate their transactions remain secure and transparent. Adhering to KYC guidelines helps businesses comply with anti-money laundering (AML) and combating the financing of terrorism (CFT) laws. These regulations aim to maintain the integrity of the financial system and protect it from illegal activities. Additionally, KYC in crypto builds trust among users and fosters a sense of legitimacy within the industry.

The Travel Rule effectively ensures that counterparty due diligence is performed, thus keeping a check between VASPs on whether they are indeed conducting thorough KYC checks. Analysis conducted by Lukka of 60 European-based VASPs in 2021 found that 21 were lacking in following KYC requirements. Increasingly lower Travel Rule thresholds set by various regulators theoretically make the act of money laundering more difficult, as there is more information exchanged by VASPs party to a transaction.

The growing popularity of digital assets has resulted in various countries introducing mechanisms to regulate crypto assets. The purpose of exercising control over them is primarily to protect investors and prevent money laundering and terrorist financing, which are the main risks associated with the sector. In the following article, we look at the current crypto regulations around the world.

Some countries have adopted more and others less restrictive rules to minimize the risks associated with digital assets. Below we take a closer look at the crypto regulations around the world.

Japan is among the pioneers in the adoption of digital assets. It was one of the first countries to recognize crypto assets as legal tender. In the Land of the Cherry Blossom, a particular Payment Services Act sets the rules for crypto regulations. crypto exchanges are subject to licensing before starting operations, reporting on transactions carried out, ensuring the security of funds, and adhering to AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures.

The FCA (Financial Conduct Authority) oversees the Bitcoin regulation and crypto regulations in the UK. A register of crypto companies has been introduced to minimize risks, in which the duty is to prevent money laundering and combat terrorist financing actively. In addition, rules for promoting crypto assets and taxation of transactions involving digital assets have been detailed. According to the announcements, the digital asset industry must be covered by the same regulations as traditional financial markets.

China has introduced the strictest crypto regulations in the world. The country’s government has imposed significant restrictions on the operations of crypto exchanges, virtually blocking the development of the market by banning crypto exchanges from operating in China. In 2019, the Chinese government also banned crypto mining to control energy consumption and protect the environment. In addition, the planned introduction of the digital yuan and its replacement with traditional cash is expected to give the state better control over financial transactions. It is worth mentioning that the PBOC, the People’s Bank of China, oversees all crypto transactions to reduce the risk of money laundering and terrorist financing. Despite these restrictions, some Chinese investors still engage in crypto trading. Some use foreign crypto exchanges or VPN virtual private networks to bypass government blockades.

In Germany, BaFin, the Federal Financial Services Authority, is responsible for crypto regulations, including holding Bitcoin. It requires companies operating in the crypto market to obtain a license and sets rules for the taxation of digital asset transactions.

Famous for its innovative solutions in the financial market, Switzerland has also developed crypto regulations applicable to players in the emerging sector. The Swiss Financial Commission (FINMA) sets rules for taxing transactions and oversees crypto companies, which must identify their customers and report suspicious activity.

South Korea has also introduced regulation of Bitcoin and other crypto assets. This Asian country has also imposed mandatory registration of crypto exchanges. The security of transactions is overseen by Korea’s Financial Services Commission (FSC). Rules have also been clarified for verifying the identity of exchanges’ customers and preventing money laundering.

The market for digital assets is in constant flux – attracting new investors, giving rise to the need to Bitcoin regulations and other cryptos. Given the massive importance of crypto in global economies, more and more countries are choosing to implement rules for the innovative sector. The challenge for governments is to regulate crypto assets in a balanced way – on the one hand, ensuring a due level of protection against risks, and on the other, allowing the market to develop freely. There is no doubt that crypto regulations around the world are necessary to shape properly the new way people use virtual assets. Time will tell whether regulations will tend toward uniformity.