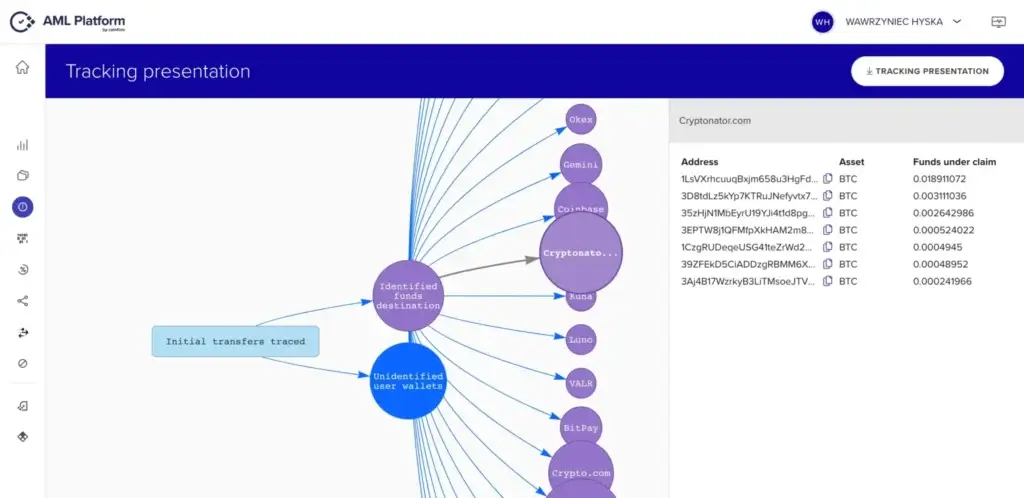

Provides detailed information about legal entities operating in the blockchain ecosystem.

Entity DD is available on the Lukka Blockchain Analytics SaaS representing entity risk exposure based on the known risk indications, and a number of useful and unique data.

Entity Due Diligence (Entity DD) provides detailed info about legal entities operating in the blockchain ecosystem, predominantly VASPs

Book a call with our experts and receive the full report about your organization.

All identified risks calculated by Lukka’s c-score formula, potential risk indicators for the entity as having been exposed to, as well as associated entities.

Summary of collected information about the entity, or the group of entities that exists under one trading name.

Including the type of license, where the company is licensed to operate or is regulated by a relevant regulatory authority, as well as the date of expiration and date granted.

Scale your operation on an as-needed basis – service transactions as they come, with no bottlenecks.

Coinfirm’s Data Science analytics team verifying all required data.

List of links to known negative news about the entity.

Speak with one of our data experts and unlock the full potential of your crypto business.

…and hundreds more businesses.

Lukka Enterprise Data Management is right for any business involved in the crypto ecosystem. The more crypto transactions you have, the more tools and techniques are required to look over your data. Lukka Prime will solve those complex challenges for you.

Lukka Enterprise Data Management uses institutional grade data ingestion that includes 30+ APIs, 130+ pre-mapped file formats, and institutional quality node data. We also give our customers manual entry software features ensuring all data is precisely collected.

The crypto ecosystem is complex and has hundreds of exchanges, trading desks, wallets, and other businesses and there are no standard asset names, tickers, file formats, or data element formats. Lukka Reference Data solves this for you and is fully automated into Lukka’s Enterprise Data Management. Once you add all of your sources, regardless of the source or ticker, Bitcoin will be Bitcoin.

Lukka uses 50+ reconciliation reports and features to ensure completeness of data. Our Customer Success team is also available to assist your business with its data challenges.

Lukka processes your data with precision based on your needs. Lukka Reference Data maps and standardizes asset names, tickers, trading pairs, and more across hundreds of venues.

Our enterprise data management software allows you to configure your pricing feed based on standardized exchange data, design a VWAP or index calculation, and produce minute by minute, hourly, and daily price reports.