As digital assets continue to gain adoption, the ability to truly understand the history and origin of funds has become critical. That’s where Lukka’s Source of Funds (SoF) analysis comes in – one of the most advanced blockchain forensic solutions available today.

With over 8 years of experience in gathering and analyzing both on-chain and off-chain data, our methodology enables us to uncover the full transactional history and provenance of digital assets tied to specific wallet addresses. The analysis spans multiple leading blockchain networks, tracing flows across native digital assets, as well as a wide range of tokens, providing a holistic view of all transactional activity.

The outcome is a highly detailed report that goes beyond raw data: it includes a risk assessment of the activities linked to the addresses and an evaluation of the counterparties those addresses have interacted with.

This level of insight is not only essential for compliance and due diligence, but also empowers businesses and institutions to make informed, data-driven decisions in the evolving world of Web3 and digital finance.

What’s the Purpose of the Source of Funds Analysis?

Lukka’s SoF analysis acts as a comprehensive due diligence mechanism. It delves into the transactional history and origins of cryptocurrency assets, providing a transparent and verifiable account of how these funds were acquired, moved, and accumulated. This detailed investigation is crucial for several reasons:

- Supporting Crypto Gain (or Loss) Realization: For crypto investors looking to convert digital wealth into fiat or integrate it into traditional portfolios, a credible SoF report is essential. Lukka’s analysis provides the transparency and documentation needed to support these transitions with confidence, especially when engaging with banks, wealth managers, or tax authorities.

- Mitigating Onboarding Risk: Entities (e.g., banks, exchanges, investment firms) that are willing to onboard cryptocurrency funds face significant regulatory scrutiny and reputational damage if they inadvertently facilitate illicit or high-risk financial activities (e.g., money laundering, terrorist financing, or transactions with sanctioned entities). A Source of Funds analysis serves as a critical risk mitigation tool, allowing these entities to:

- Assess the Legality of Funds: By tracing the transactional path of cryptocurrencies, the analysis can identify any connections to known illicit activities or sanctioned entities.

- Ensure Regulatory Compliance: It helps entities adhere to Anti-Money Laundering (AML) regulations, which are paramount in the financial sector.

- Protect Against Reputational Damage: By thoroughly vetting the source of funds, entities can avoid associating with or facilitating transactions linked to illegal or unethical practices, thereby preserving their integrity and trustworthiness.

- Assess the Legality of Funds: By tracing the transactional path of cryptocurrencies, the analysis can identify any connections to known illicit activities or sanctioned entities.

Integrating On-Chain and Off-Chain Data:

Our SoF methodology integrates on-chain blockchain analytics with off-chain intelligence to produce a comprehensive, defensible financial narrative:

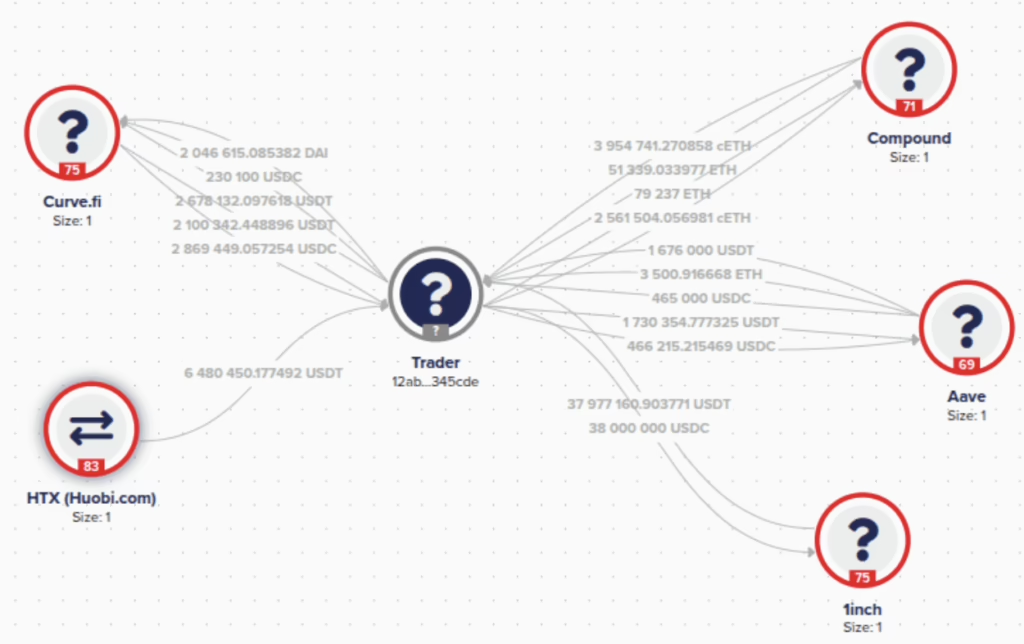

- On-Chain Analysis: This forms the bedrock of the investigation, examining all available blockchain records for the specified scope of addresses. Advanced analytical tools and techniques are applied to identify patterns, cluster addresses belonging to the same entity and visualize complex transaction flows. On-chain analysis includes identifying the connections with both centralized and decentralized entities.

- Off-Chain Data Integration: Not all relevant information resides directly on the blockchain. The off-chain component encompasses data not explicitly recorded on the distributed ledger. This often includes, but is not limited to:

- Trading History on Centralized Exchanges: Accessing and analyzing records from centralized exchanges can provide invaluable context regarding the flow of funds.

- Open-Source Intelligence (OSINT): Utilizing publicly available information to corroborate findings and gather additional contextual intelligence.

- Internal Client Data: Leveraging any internal data provided by the client that can shed light on the activities of the target addresses.

- Historical pricing data: Lukka’s internal database includes historical prices for many crypto assets. Thanks to this feature we’re able to track an exact value in fiat currency at the time of transactions and reconcile the balance of the funds held on the analyzed addresses.

- Trading History on Centralized Exchanges: Accessing and analyzing records from centralized exchanges can provide invaluable context regarding the flow of funds.

By utilizing both on-chain and off-chain data we are able to re-create the entire flow of funds from their origin to the addresses on which the funds reside.

Real-Life Cases

Every Source of Funds analysis is unique, and so are the circumstances behind it. Lukka brings deep expertise and flexibility to each engagement, adapting our approach to meet the specific needs of the case. With over 10 years of experience across the crypto ecosystem, we’ve handled a wide range of complex scenarios, including both conventional and emerging use cases.

Crypto Tokens Trading

Our analysis extends beyond a calculation of generated profits; it delves into the intricate web of financial flows, trading patterns, and associated risks. Understanding the nuances of this analysis is paramount for financial institutions, regulators, and individuals engaging in the crypto market. The core objectives of SoF analysis in crypto trading are:

- Risk Identification and Mitigation: This is perhaps the most crucial aspect. SoF analysis in crypto trading is acutely focused on uncovering and assessing various risk factors:

- Trading Pattern Risks: Certain trading strategies can be indicative of illicit activities such as market manipulation, wash trading, or front-running. The analysis scrutinizes trading volumes, frequency, and correlation with market events to flag suspicious patterns.

- Traded Token Risks: The specific crypto tokens being traded are themselves subject to scrutiny. The analysis would consider the token’s market capitalization, liquidity, and the reputation of its development team, among other factors. Furthermore, assets associated with known illicit activities would be identified as red flags immediately. For cases including trading of assets such as meme coins or NFTs we offer custom risk indicators to assess all the risks related to this kind of assets and activities.

- Counterparty Risks: Identifying and assessing the risks posed by the counterparties involved in the trading process is vital. This includes the exchanges used, the addresses involved in transactions, and any associated entities. The presence of unidentified or suspicious counterparty addresses, or those linked to sanction lists, would be a major red flag.

- Trading Pattern Risks: Certain trading strategies can be indicative of illicit activities such as market manipulation, wash trading, or front-running. The analysis scrutinizes trading volumes, frequency, and correlation with market events to flag suspicious patterns.

- Net Profitability Calculation and Verification: This involves tracking the initial capital invested, subsequent trades, and the final net gains or losses, ensuring transparency and adherence to financial regulations. This step also reconciles the amount of funds to be onboarded by our clients, providing a clear picture of the overall performance of the trading activity.

We have experience handling various types of activities including: mining, deployments of token smart contracts, algorithmic trading using bots, DeFi activities or analyses of trades on centralized exchanges based on the documentation provided by our clients. Every case requires a specific approach to provide the best outcome.

Lukka & Big Four Audit Firm Cooperation

Lukka has partnered with one of the Big Four audit firms to assist financial institutions in confidently onboarding clients who have acquired wealth through digital assets. This close collaboration bridges the gap between digital assets and traditional finance. Lukka provides detailed reports on the source of crypto assets for clients looking to realize their gains through financial institutions. By combining Lukka’s expertise in blockchain analysis and cryptocurrency AML with the firm’s strong financial and compliance standards, we deliver high-quality, bank-compliant documentation that includes comprehensive risk assessments to address cryptocurrency-related risks.

This partnership offers significant benefits to all parties. Lukka gains a strategic partner, allowing access to the traditional financial market. The firm expands into the crypto sector by leveraging Lukka’s expertise. Banks can safely increase their cash flow by onboarding new customers who can realize their crypto wealth through established financial entities.

The cooperation follows a structured and organized process with clear communication. Initially, the firm provides a case request from their client bank. Lukka evaluates the case complexity and conducts a pre-assessment analysis based on the provided information. Lukka then communicates with the firm about the data required for a full analysis. All requested information is collected and managed by the bank and prospective client, ensuring it remains under their control. Once the necessary data is securely shared, Lukka proceeds with the analysis. If additional findings emerge, communication is maintained with clients for clarification and potential scope expansion. After Lukka completes its part of the report, the firm reviews it, suggesting improvements to make the report clearer for readers who may not be familiar with the crypto space. Additionally, the firm performs the Control Over Digital Assets (CODA) process to verify the ownership of the cryptocurrency being the subject of our analysis.

Unverified crypto can cost you, let Lukka help prove where your funds came from.