In the world of crypto, where volatility is often the only constant, the way we value digital assets becomes paramount. Pricing by many platforms can be unvetted or inconsistent, generating more noise than truth. This ‘noise’ often manifests as inconsistent and unreliable data, leading to confusion, misinformed decisions, and potential financial inaccuracies.This is where Lukka Prime’s Fair Market Value approach, aligned with US GAAP and IFRS requirements and principles, particularly ASC 820 – Fair Value (and IFRS13), proves its mettle.

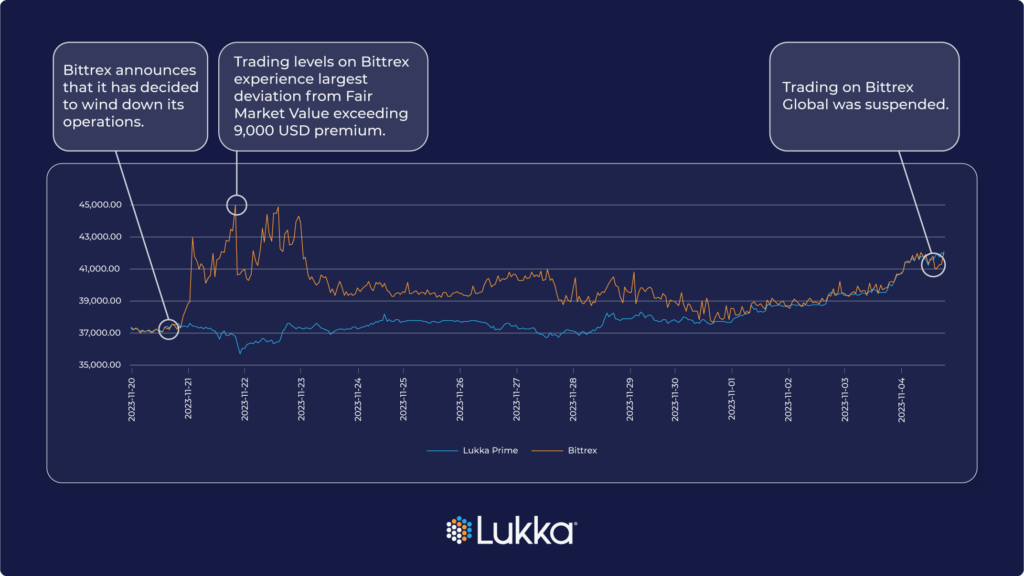

The Bittrex Closure Announcement: A Case Study

The chart of Bitcoin trading levels around the Bittrex closure serves as an exemplary case of how market events can lead to significant price volatility. This instance demonstrates the potential pitfalls of unreliable valuation methods that can be swayed by short-term market disruptions. Lukka Prime’s approach mitigates such risks by offering valuations, with strong oversight and governance, that remain steadfast against fleeting market trends. In this specific case, conventional Volume Weighted Average Price, or VWAPs, would include this data and thus skew valuations to the point of potentially being misleading.

Lukka’s Dedication to Quality and Transparency

Lukka Prime’s methodology is designed to cut through the market’s variable nature by providing a Fair Market Value that reflects a true and orderly transaction, aligning with rigorous financial reporting standards. Let’s delve into the specifics (using US GAAP references which also can be mapped to the relevant IFRS standards):

Market-Based, Orderly Transaction Approach: Lukka Prime aligns with ASC 820-10-05-1B, ensuring that asset prices are reflective of what the market truly dictates at the measurement date.

Active Principal Market Identification: It uses a methodical approach to identify the market with the greatest volume and activity level for the asset, consistent with US and international accounting standards and to the non-authoritative AICPA Digital Assets Practice Aid.

Dynamic Market Assessment: Lukka Prime’s dynamic assessment of the principal market ensures that it can quickly adapt to material changes or market disruptions, identifying the most reliable market for valuation purposes.

Unadjusted Exit Prices: Lukka Prime utilizes the exit price from the identified principal market, as mandated by ASC 820-10-35-6A & 9A, resisting the urge to use averages or to adjust for short-lived fluctuations or block trades.

Transparency and Peer Review: The methodology’s credibility is bolstered by its availability in a White Paper and its publication in a top tier peer-reviewed academic accounting journal.

Lukka’s Commitment to Quality

Lukka’s dedication to quality is further reinforced by:

- Comprehensive Certifications: Lukka SOC 1® Type II and SOC 2® Type II reports, and has achieved ISO/IEC 27001 Certification, showcasing its commitment to operational excellence and data security.

- IOSCO Principles Compliance: The review against IOSCO Principles for Financial Benchmarks by an independent Big 4 accounting firm validates Lukka Prime’s global standing.

- Price Integrity Oversight Board: The governance by this board ensures Lukka’s pricing methodologies remain accurate and appropriate amidst market and regulatory changes.

- Comprehensive Certifications: Lukka SOC 1® Type II and SOC 2® Type II reports, and has achieved ISO/IEC 27001 Certification, showcasing its commitment to operational excellence and data security.

While the Bittrex is just one example, it serves to show the importance of Lukka Prime’s reliable valuation in a sometimes unpredictable market. In such an environment, the quality of data and the integrity of valuation methodologies are not just beneficial but essential. Lukka Prime stands out as a solution that offers stability, transparency, and reliability in crypto asset pricing. As the industry matures, the demand for such quality will only intensify, making Lukka Prime’s contributions all the more valuable for those seeking robust, reliable valuations amidst the tumultuous seas of the crypto markets.