November 10, 2025

The Canton ecosystem reached a major milestone today as Canton Coin (CC) began spot trading across 11 global exchanges – a defining moment in the evolution of regulated, interoperable tokenized markets.

This launch represents more than a new listing. It demonstrates how tokenized ecosystems can operate with institutional-grade transparency, valuation accuracy, and compliance discipline from day one.

As the provider of the Canton Coin Reference Rate and Fair Market Value (FMV) pricing, Lukka supplies the market with audit-ready data and real-time analytics – the infrastructure institutions and regulators rely on to price, report, and manage digital assets confidently.

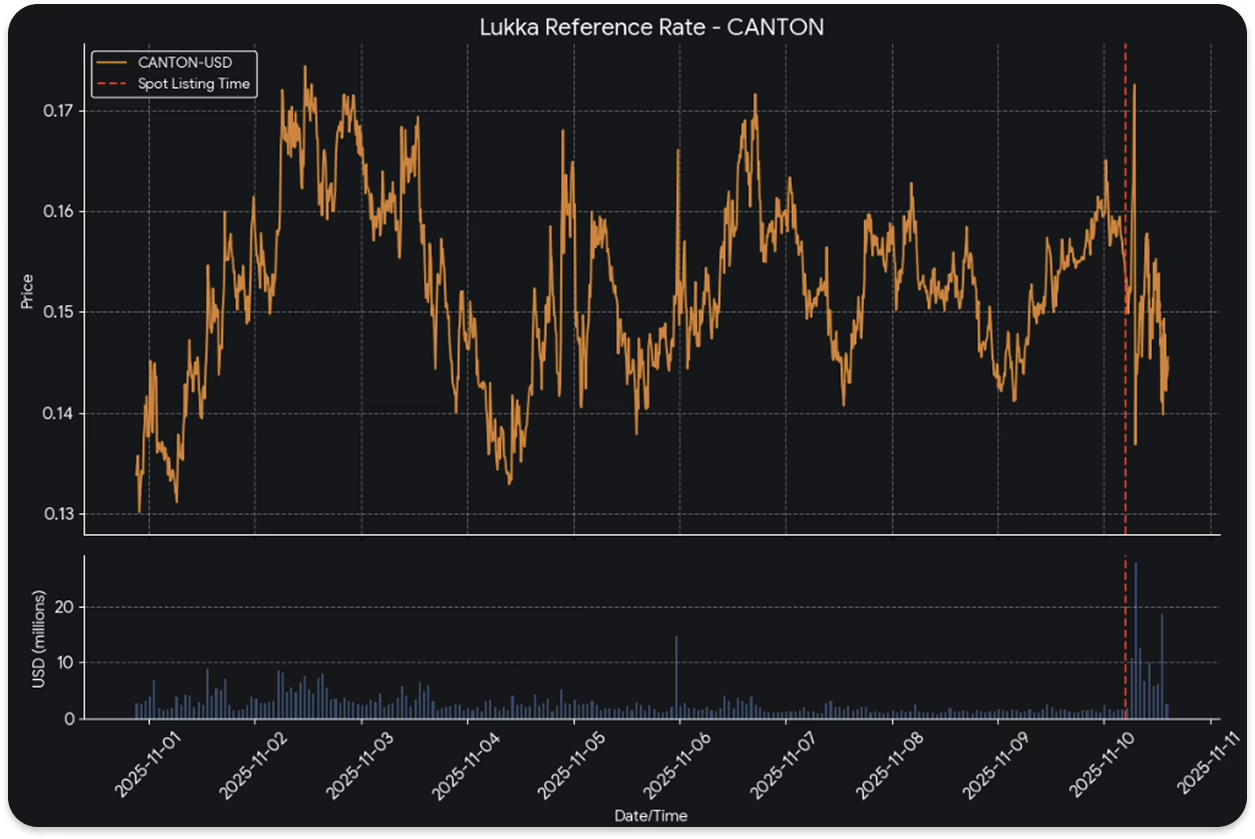

Canton Coin Price Action and Trading Volume

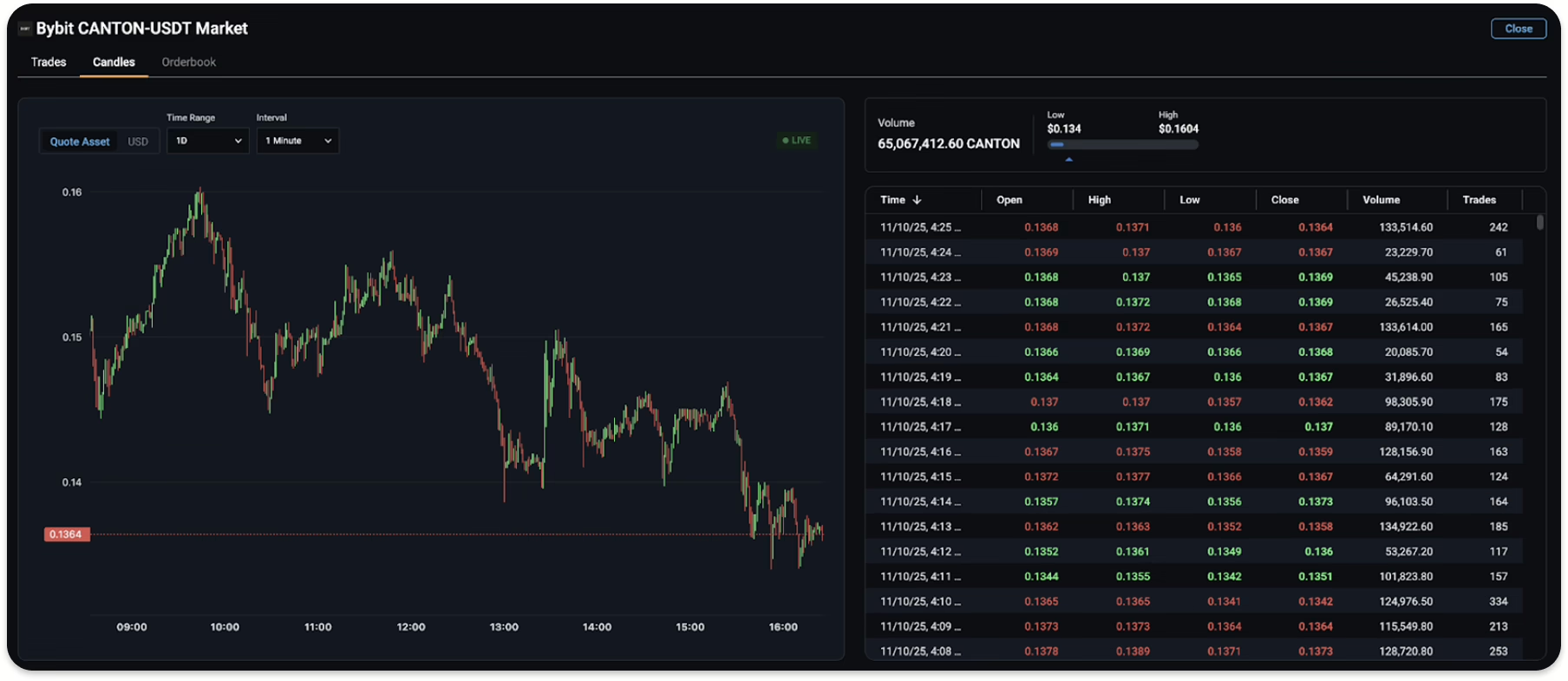

Spot Market Launch:

Canton Coin began trading at 7:00 a.m. UTC, opening near $0.15, rising to $0.16 around 9:44 a.m. UTC, and stabilizing near $0.125 by 4:49 p.m. UTC.

Market Snapshot

- 11 exchanges currently list Canton Coin spot markets

- 16 total spot trading pairs

- Kraken supports fiat pairs (USD, EUR)

- MEXC, Kraken, and Bybit list USDC pairs; all other venues trade USDT pairs

Pre-Market Perpetuals:

Before spot trading began, several venues launched perpetual futures contracts in late October and early November.

- Traded prices ranged from $0.12728 – $0.25449, reaching a high on Hyperliquid (Nov 5)

- Excluding outliers, OKX peaked at $0.18474 (Nov 4)

- Average daily perpetual volume: $67.3 million

- Binance and OKX accounted for over 60 % of cumulative perp activity since October 31

This pre-market derivatives activity provided liquidity and transparent price discovery ahead of the spot launch, an emerging best practice for institutional token listings.

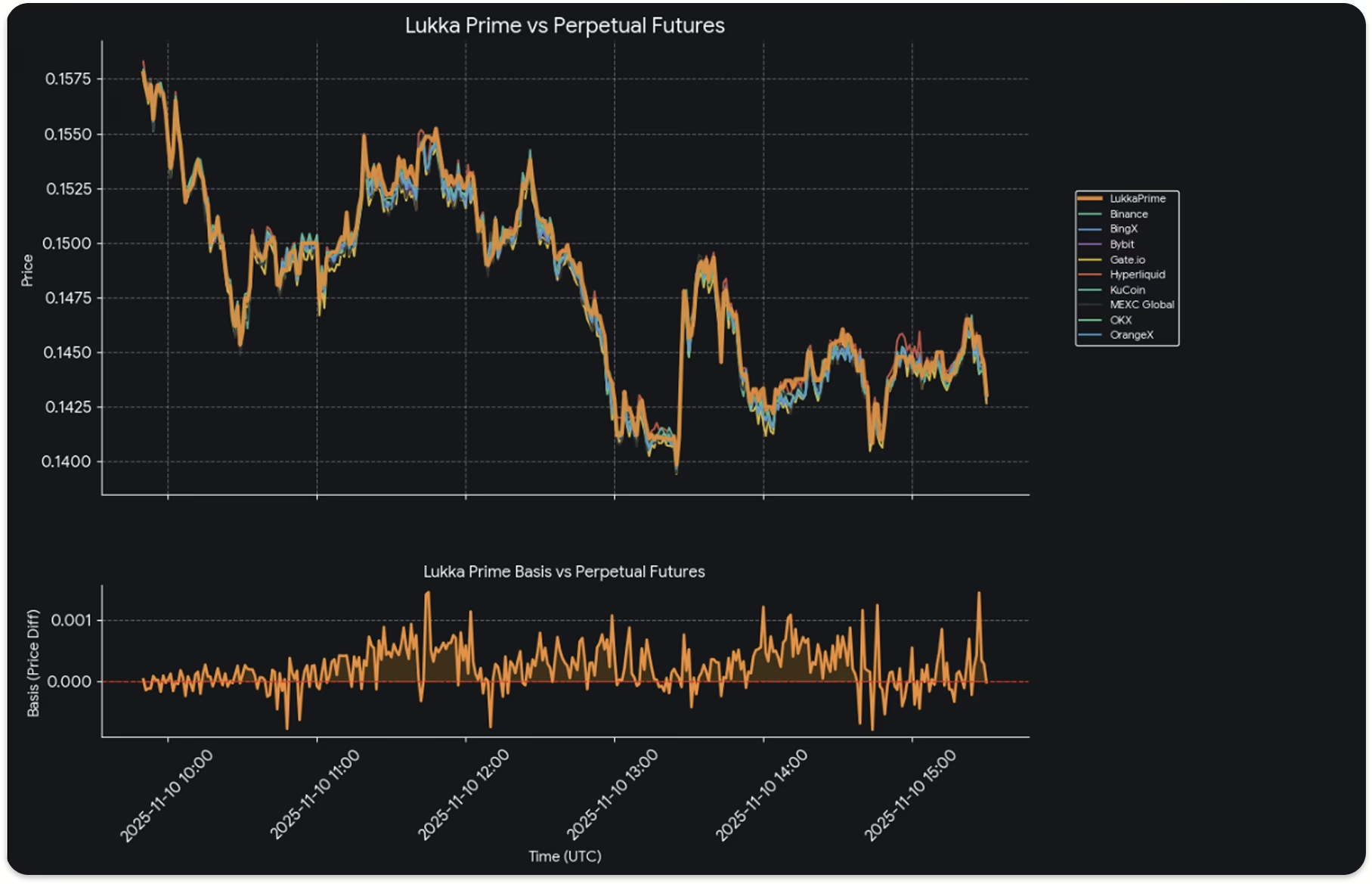

Spot-Versus-Perpetual Market Dynamics

Canton’s rollout illustrates the growing sophistication of tokenized market structures.

In its “pre-market” phase, perpetual contracts served as the primary valuation mechanism. With funding rates near zero and settlements based on executed trade prices, the spot–perp basis has remained tight since launch.

Using Lukka Prime’s FMV pricing, which aggregates executed spot trades across regulated exchanges, institutions can observe that the Canton Coin spot market closely tracks perpetuals, signaling efficient and orderly price formation.

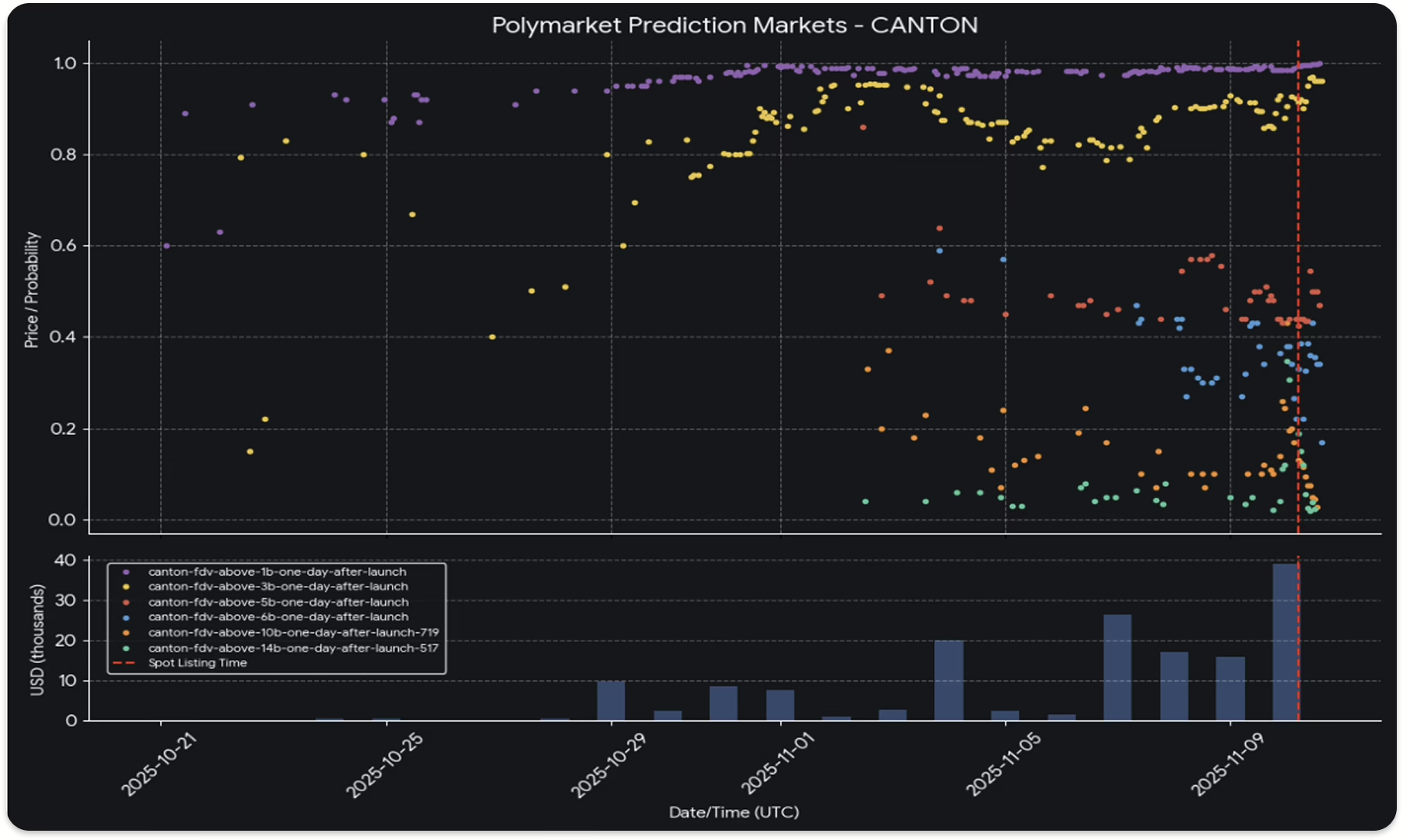

Prediction Markets Signal Institutional and Retail Engagement

Canton Coin’s debut has also been reflected in on-chain prediction venues such as Polymarket, where two markets attracted early liquidity:

- Will Canton launch a token in 2025?

- Canton FDV above ___ one day after launch?

Traders could choose thresholds of $1B, $3B, $5B, $6B, $10B, and $14B.

Current pricing implies a 45 % probability that Canton’s Fully Diluted Value will exceed $5 billion one day post-launch, with $226,173 in cumulative volume. Activity spiked following the perpetual listings and accelerated after the spot markets went live – evidence of a deepening ecosystem of market participants.

Exchange Listings and Custody Support Strengthen Market Infrastructure

Exchange listings and institutional custody integrations mark critical inflection points for tokenized assets. Together, they create the accessibility and safeguards required for institutional participation.

Key Benefits:

- Liquidity & Price Discovery: Continuous trading across multiple venues enhances transparency and tightens spreads.

- Market Accessibility: Listings extend reach to global retail and institutional users through regulated venues.

- Derivatives Infrastructure: Futures and perpetuals enable hedging, leverage, and structured risk management.

- Data Transparency: Standardized, independently sourced market data and auditable histories underpin financial reporting and compliance.

- Network Effects: Additional listings drive volume, which improves liquidity and attracts further participants.

Institutional-grade custody complements these market benefits by enabling qualified custodians to safely hold Canton Coin for clients, meeting fiduciary and operational standards that traditional allocators demand.

Lukka’s Role in Enabling Transparent and Compliant Tokenized Markets

Lukka’s institutional data infrastructure supports every stage of Canton Coin’s lifecycle, from pricing and reporting to compliance and counterparty oversight.

Lukka Reference Data:

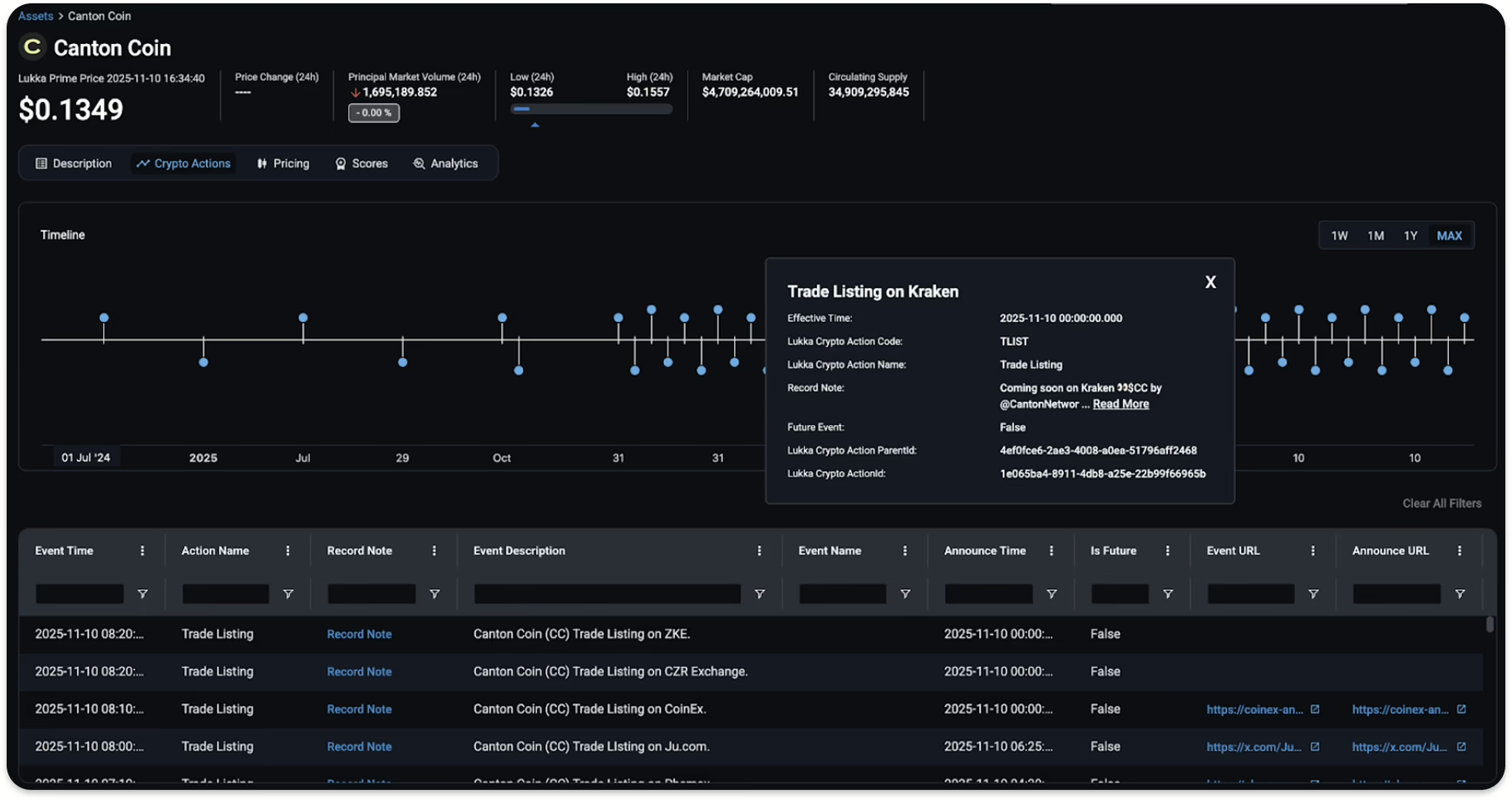

Normalizes identifiers, mappings, and classifications across 1.5 million+ assets and 500+ mapped entity sources, establishing a single, authoritative dataset for pricing, compliance, and reporting.Lukka Crypto Actions:

Tracks 45+ event types, from listings and rebrands to custody support, maintaining complete historical lineage and ensuring accurate, regulator-ready data across every market event.VASP Coverage (within Lukka Reference Data):

Provides detailed intelligence on 17,000+ Virtual Asset Service Providers, mapping legal entities, jurisdictions, licensing, and compliance status to streamline AML, KYC, and due-diligence workflows.

Together, these capabilities form the data backbone of institutional tokenization, enabling the Canton ecosystem, and the broader digital-asset market, to operate with transparency, auditability, and confidence.

Institutional Data Integrity as the Foundation for Tokenized Finance

For tokenization to scale, markets require standardized valuation methodologies, verified reference data, and transparent event tracking.

Lukka enables this by providing:

- Peer-Reviewed Methodologies with full audit trails

- Independent Oversight through SOC 1 & SOC 2 Type II audits and IOSCO benchmark adherence

- Flexible Data Delivery via API, FIX, WebSocket, and SFTP integrations

- Accounting and Regulatory Alignment to global financial-reporting standards

This infrastructure ensures that tokenized markets like Canton evolve with the same operational rigor and data reliability that define traditional finance.

Conclusion: Building the Future of Institutional Digital Assets

Canton Coin’s launch demonstrates what the next phase of finance looks like – regulated tokenized assets operating on verifiable data and transparent valuation frameworks.

From pre-market derivatives to spot trading and custody integration, the Canton ecosystem illustrates how Lukka’s data infrastructure supports every layer of a compliant, institutional-ready market.

As tokenization accelerates across asset classes, Lukka continues to deliver the pricing, reference data, and analytics that form the backbone of trustworthy, regulator-ready digital asset operations.

Learn More

Explore how Lukka Prime, Reference Data, and Crypto Actions support institutional pricing, compliance, and risk management across tokenized markets.