Millions of Tax Payers will be impacted. Preparers Need a Solution:

An estimated 11% of the US population, around 36 million people, owned Bitcoin, the world’s most widely known cryptocurrency, as of April 2019. Add to that holders of the other crypto assets, and a possible 50 million people could be impacted by new tax reporting requirements for 2019. This week, the IRS made it clear that if US taxpayers participated in any activity (buying, selling, or receiving) involving crypto assets in 2019, the onus will be on the individual to self-disclose and report.

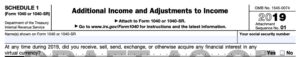

“Virtual Currency” Question tops the Form:

A sneak peek of the (Draft) 2019 Form 1040 Schedule 1, issued this week by the IRS, puts this question above all others…

At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

Updates to the Form 1040, combined with new guidance also issued this week on crypto asset transactions and reporting, means the race is on to be ready to support US taxpayers in filing accurate and timely returns.

Help for the Tax Preparation Industry:

Calculating what is owed on crypto asset transactions is where Lukka can help…

Already the trusted leader in blockchain-native technology, and armed with a suite of products purpose-built for crypto asset processing, Lukka is uniquely prepared for the rush. Tax preparation professionals will need industrial-grade, trusted tools to automate and optimize crypto asset tax calculations in order to support clients in meeting newly-defined tax obligations.

The move by the IRS is truly an earthshaking change for the tax preparation industry, and crypto asset investors themselves. Further, this indication is coming with less than 90 days before the end of the tax year.

For more information on how Lukka can help businesses address the daunting task of accurate crypto currency tax assessment for their clients, please visit lukka.tech.